Sector

FinTech

Team

2 designers

Duration

Ongoing

Platform

Android, IOS

Screens

500+

Software used

Sector

FinTech

Team

2 designers

Duration

Ongoing

Platform

Android, IOS

Screens

500+

Software used

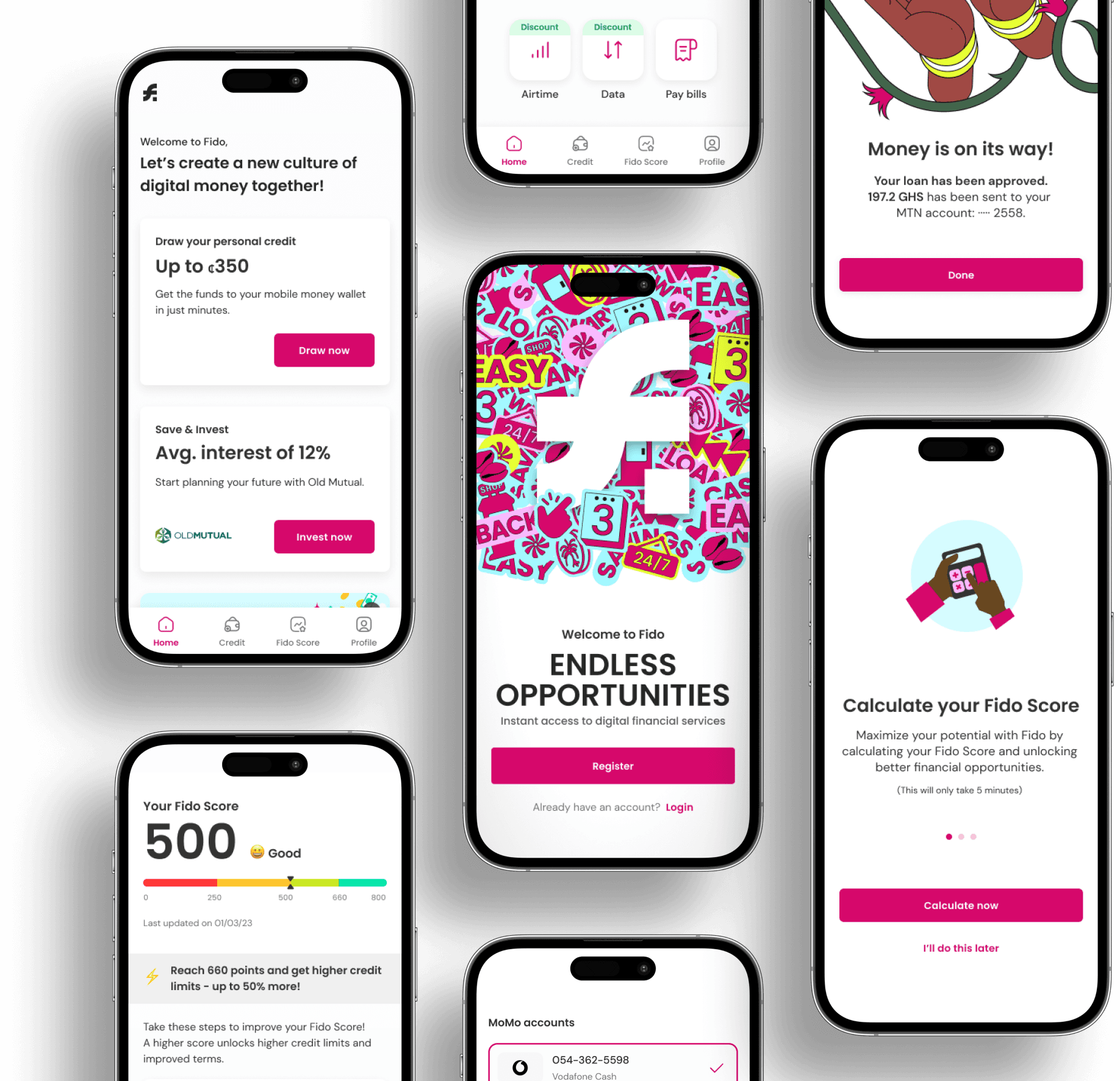

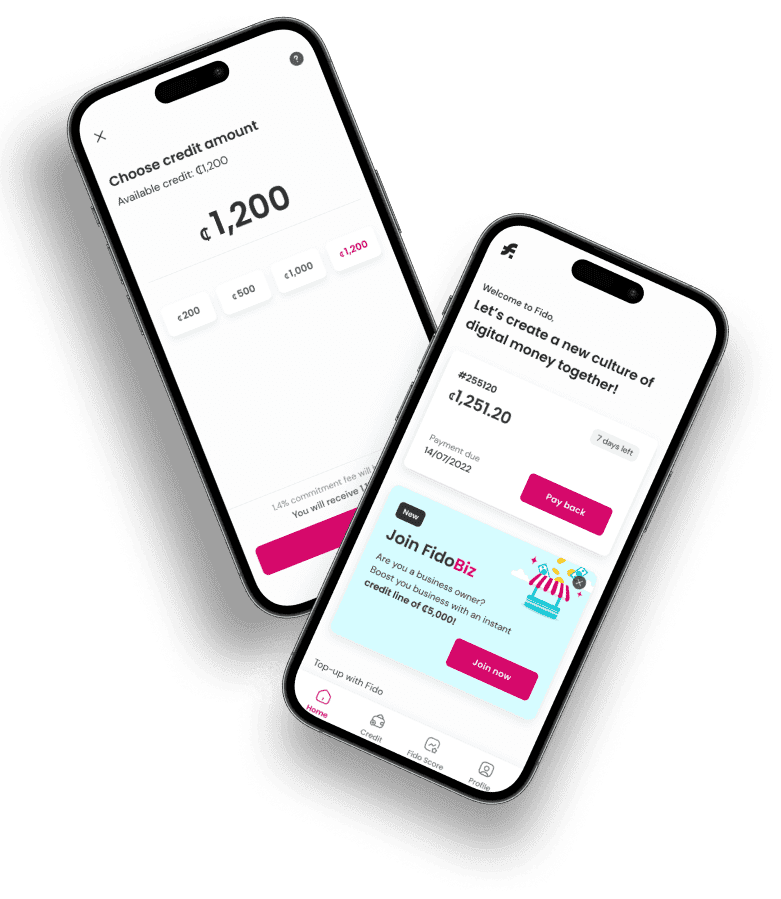

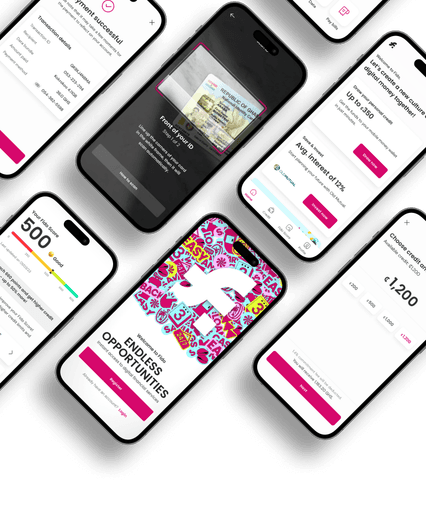

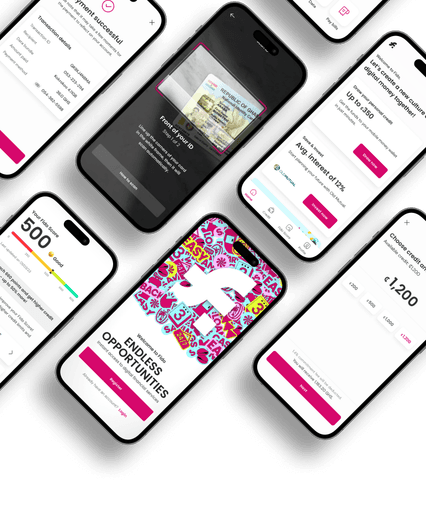

Fido

Accessible & Inclusive financial opportunities in Africa

Fido

Accessible & Inclusive financial opportunities in Africa

Sector

FinTech

Team

2 designers

Duration

Ongoing

Platform

Android, IOS

Screens

500+

Software used

Overview

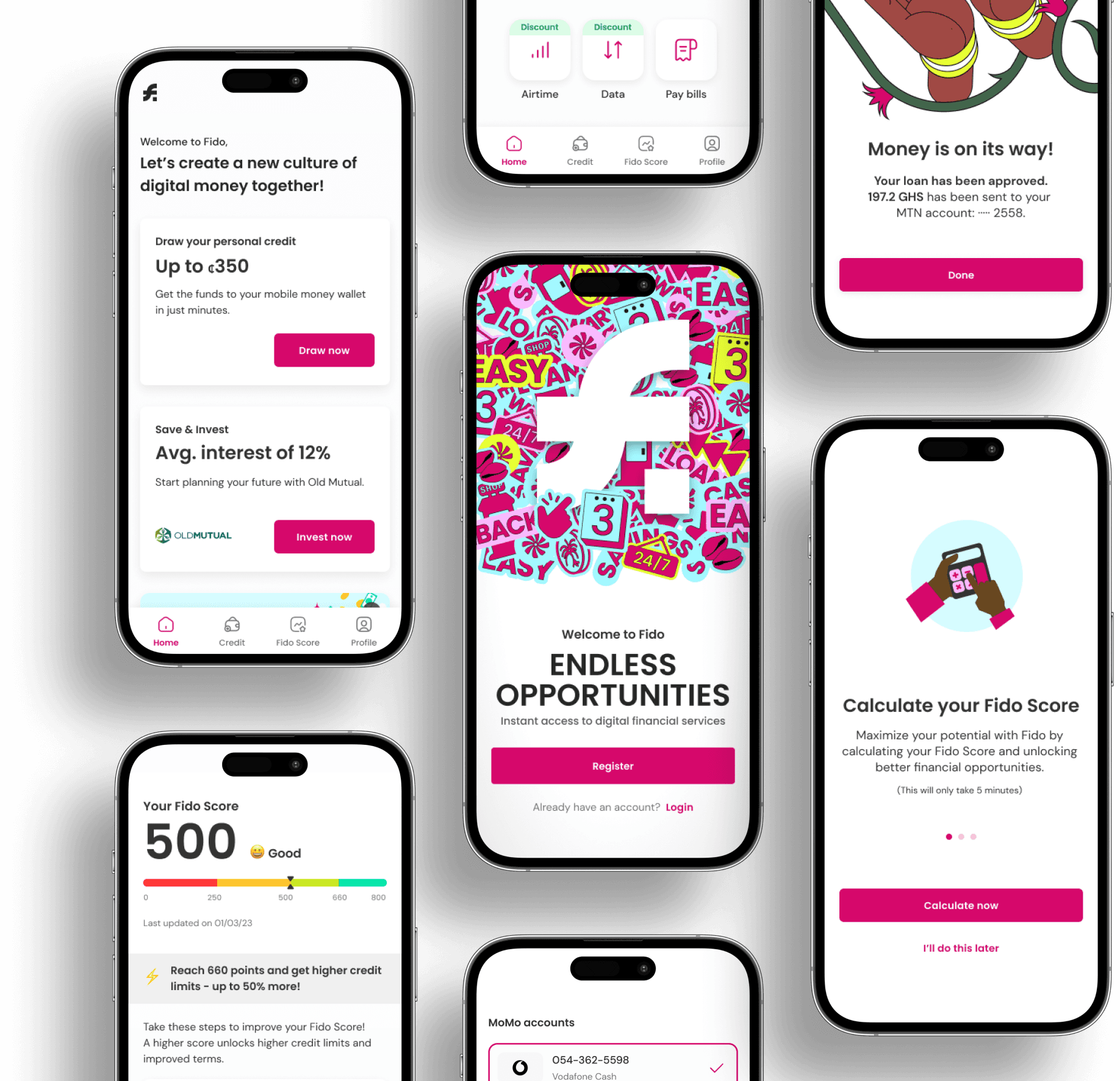

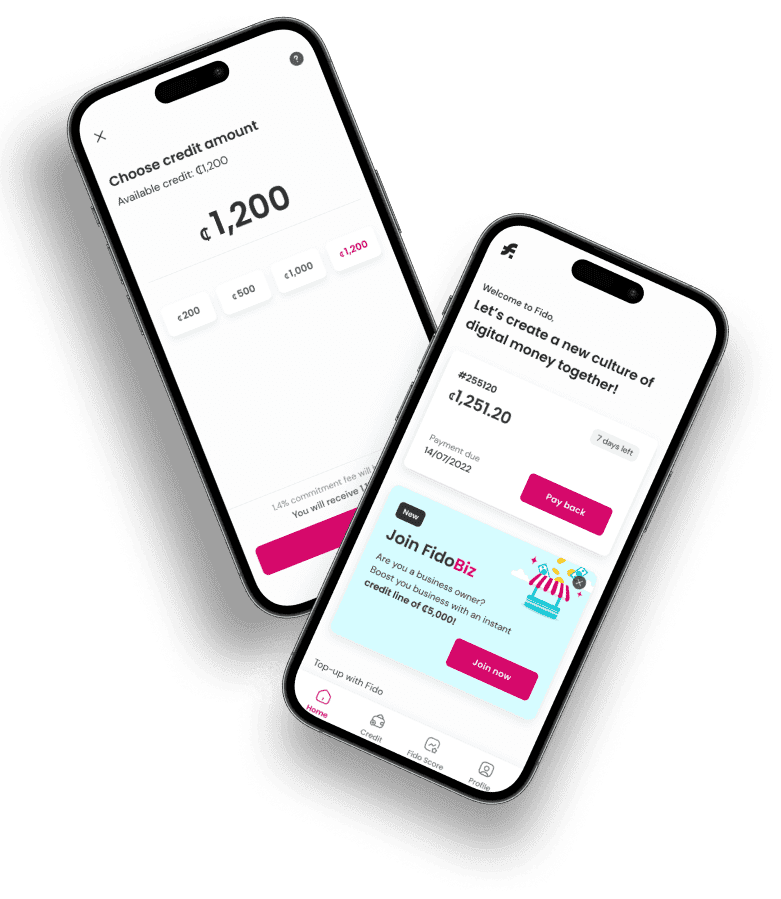

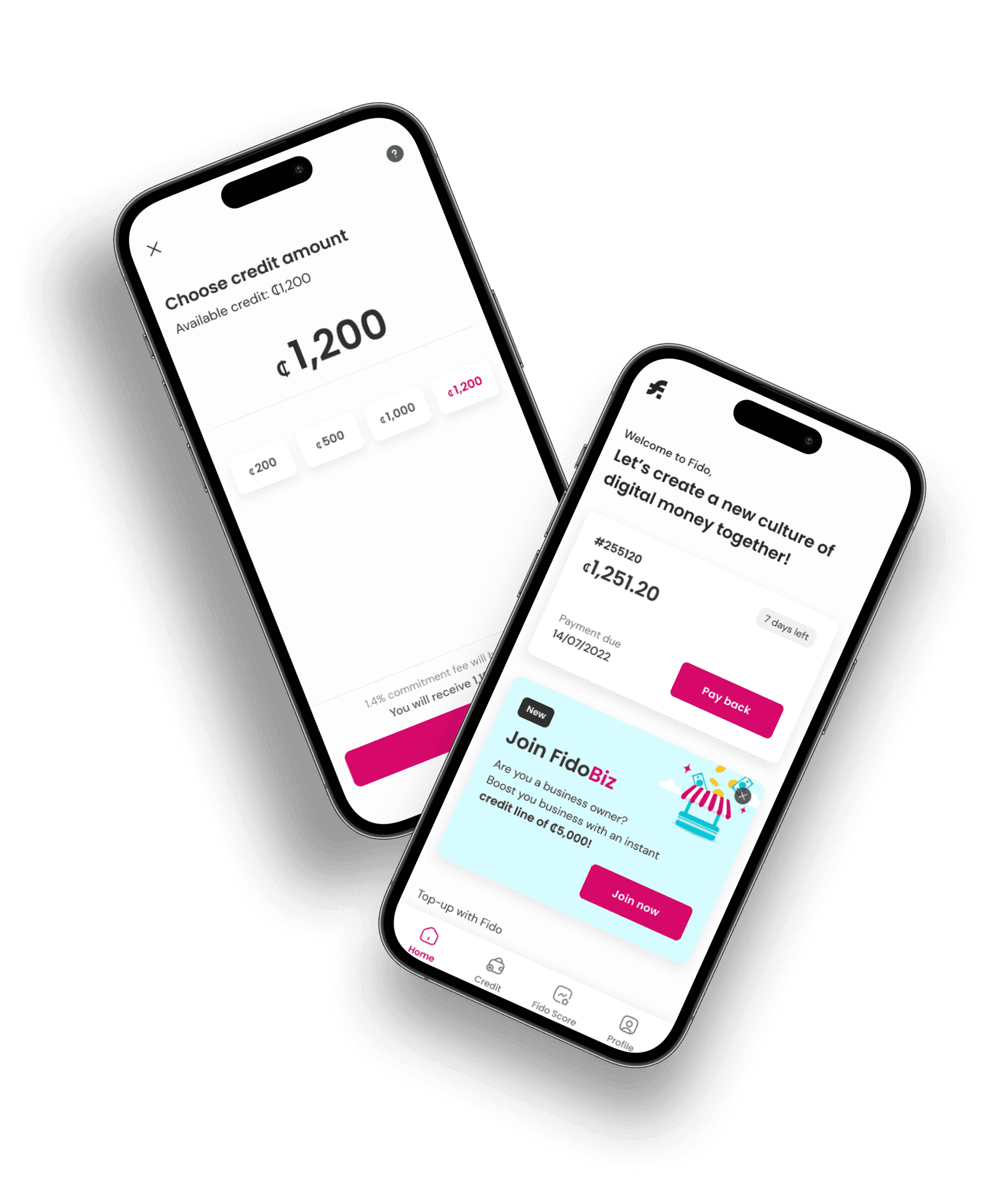

The Fido app provides accessible and inclusive financial services tailored to unbanked individuals in Africa. It allows users to quickly obtain credit, establish a solid financial identity, and efficiently manage their finances.

My role

My role

As one of the two designers on Fido’s product design team, my responsibilities include:

As one of the two designers on Fido’s product design team, my responsibilities include:

UX/UI design

UX/UI design

Creating end-to-end flows, developing new features, and designing high-fidelity screens and prototypes.

User-Centric Enhancement

Conducting surveys, user interviews, and user testing sessions to gather valuable insights.

Interdisciplinary Team Engagement

Interdisciplinary Team Engagement

Working with diverse departments including Marketing, Product, Data, and Developers, ensuring cohesive project execution.

Working with diverse departments including Marketing, Product, Data, and Developers, ensuring cohesive project execution.

Global collaboration

Global collaboration

Collaborating seamlessly with teams across Israel, Ghana, and Uganda

Collaborating seamlessly with teams across Israel, Ghana, and Uganda

Scope

Scope

Since 2016, Fido's initial product in Ghana centered on micro-loan distribution, but faced challenges with outdated design and poor UX/UI. A transformative moment came in 2021 with a $30 million investment, establishing an Israeli office and recruiting me to lead the redesign and relaunch of the new app. The process kicked off with a focused design sprint, aiming to revamp the existing loans feature into an MVP within three months. Achieving this, our team progressed to ongoing improvements, introducing new features, and expanding into markets like Uganda and South Africa.

Constraints

Constraints

Operating as a globally distributed company brought forth several challenges:

Operating as a globally distributed company brought forth several challenges:

Geographical distance

Geographical distance

Time zone differences and logistical challenges between the Israel office and African teams.

Time zone differences and logistical challenges between the Israel office and African teams.

Technology disparities

Technology disparities

Limited data, older Android devices, and users' unfamiliarity with standard app interactions

Limited data, older Android devices, and users' unfamiliarity with standard app interactions

Bureaucratic complexity

Bureaucratic complexity

Unique legal regulations and administrative procedures in the African region, adding an extra layer of complexity to operations.

Unique legal regulations and administrative procedures in the African region, adding an extra layer of complexity to operations.

Fast-paced dynamics

Fast-paced dynamics

Operating within a dynamic Fintech startup, where tight deadlines and daily changes are the norm, requiring constant adaptability and agility.

Operating within a dynamic Fintech startup, where tight deadlines and daily changes are the norm, requiring constant adaptability and agility.

Problem statement

Over 70% of the population in Africa faces barriers to financial inclusion due to limited access to traditional banking. Unbanked citizens encounter challenges in accessing financial services due to the absence of a financial identity and credit history, hampering their ability to secure loans or open bank accounts.

Without accessible credit and financial products, people struggle to cover essential expenses such as housing bills, education, and healthcare. They often resort to informal lending or costly alternatives, worsening their financial situation.

The social-economic challenges ahead

The social-economic challenges ahead

Designing a product for users in Africa while being based in Israel presented a unique challenge. To create an app that truly resonates with our users and impacts their lives positively, understanding their daily struggles and aspirations was paramount. But bridging this gap across continents demanded innovative strategies:

Cultural diversity

Navigating diverse cultural, social, and economic backgrounds among users, understanding their unique perspectives and needs

Financial literacy gap

Addressing the lack of financial knowledge among users, designing interfaces that bridge this gap and deliver essential financial information

Empathy development

Cultivating empathy for users' daily struggles, dreams, and aspirations, understanding their emotional landscape

Avoiding assumptions

Overcoming preconceptions about users' behaviors and preferences required extensive research and a willingness to challenge stereotypes

Communication barriers

Dealing with Language differences and varying communication styles. Effectively communicating the app's functionality and benefits

Cultural sensitivity

Ensuring the app's features align with local customs and practices required deep cultural understanding

Sector

FinTech

Team

2 designers

Duration

Ongoing

Platform

Android, IOS

Screens

500+

Software used

Overview

The Fido app provides accessible and inclusive financial services tailored to unbanked individuals in Africa. It allows users to quickly obtain credit, establish a solid financial identity, and efficiently manage their finances.

My role

As one of the two designers on Fido’s product design team, my responsibilities include:

UX/UI design

Creating end-to-end flows, developing new features, and designing high-fidelity screens and prototypes.

User-Centric Enhancement

Conducting surveys, user interviews, and user testing sessions to gather valuable insights.

Interdisciplinary Team Engagement

Working with diverse departments including Marketing, Product, Data, and Developers, ensuring cohesive project execution.

Global collaboration

Collaborating seamlessly with teams across Israel, Ghana, and Uganda

Scope

Since 2016, Fido's initial product in Ghana centered on micro-loan distribution, but faced challenges with outdated design and poor UX/UI. A transformative moment came in 2021 with a $30 million investment, establishing an Israeli office and recruiting me to lead the redesign and relaunch of the new app. The process kicked off with a focused design sprint, aiming to revamp the existing loans feature into an MVP within three months. Achieving this, our team progressed to ongoing improvements, introducing new features, and expanding into markets like Uganda and South Africa.

Constraints

Operating as a globally distributed company brought forth several challenges:

Geographical distance

Time zone differences and logistical challenges between the Israel office and African teams.

Technology disparities

Limited data, older Android devices, and users' unfamiliarity with standard app interactions

Bureaucratic complexity

Unique legal regulations and administrative procedures in the African region, adding an extra layer of complexity to operations.

Fast-paced dynamics

Operating within a dynamic Fintech startup, where tight deadlines and daily changes are the norm, requiring constant adaptability and agility.

Problem statement

Over 70% of the population in Africa faces barriers to financial inclusion due to limited access to traditional banking. Unbanked citizens encounter challenges in accessing financial services due to the absence of a financial identity and credit history, hampering their ability to secure loans or open bank accounts.

Without accessible credit and financial products, people struggle to cover essential expenses such as housing bills, education, and healthcare. They often resort to informal lending or costly alternatives, worsening their financial situation.

The social-economic challenges ahead

Designing a product for users in Africa while being based in Israel presented a unique challenge. To create an app that truly resonates with our users and impacts their lives positively, understanding their daily struggles and aspirations was paramount. But bridging this gap across continents demanded innovative strategies:

Cultural diversity

Navigating diverse cultural, social, and economic backgrounds among users, understanding their unique perspectives and needs

Financial literacy gap

Addressing the lack of financial knowledge among users, designing interfaces that bridge this gap and deliver essential financial information

Empathy development

Cultivating empathy for users' daily struggles, dreams, and aspirations, understanding their emotional landscape

Avoiding assumptions

Overcoming preconceptions about users' behaviors and preferences required extensive research and a willingness to challenge stereotypes

Communication barriers

Dealing with Language differences and varying communication styles. Effectively communicating the app's functionality and benefits

Cultural sensitivity

Ensuring the app's features align with local customs and practices required deep cultural understanding

Design sprint

Design sprint

The process started with a Design Sprint that kicked off on my first day at Fido.

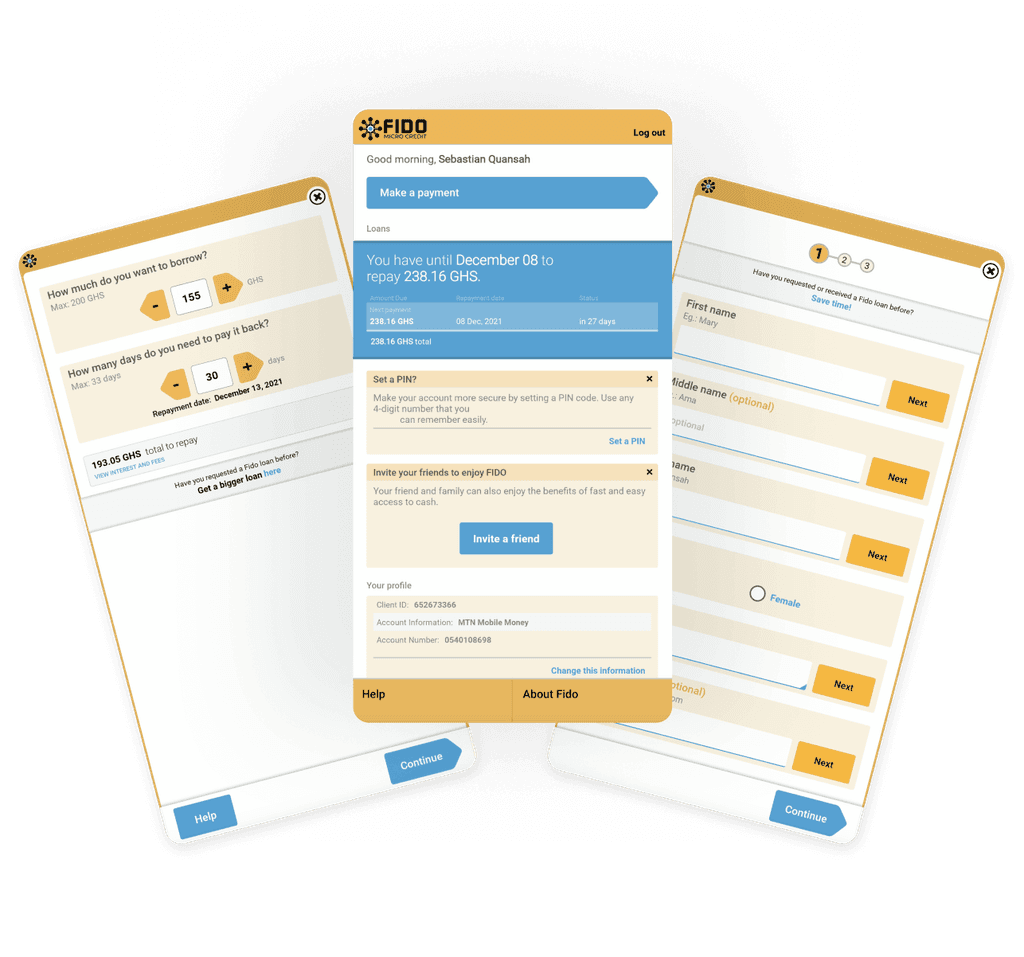

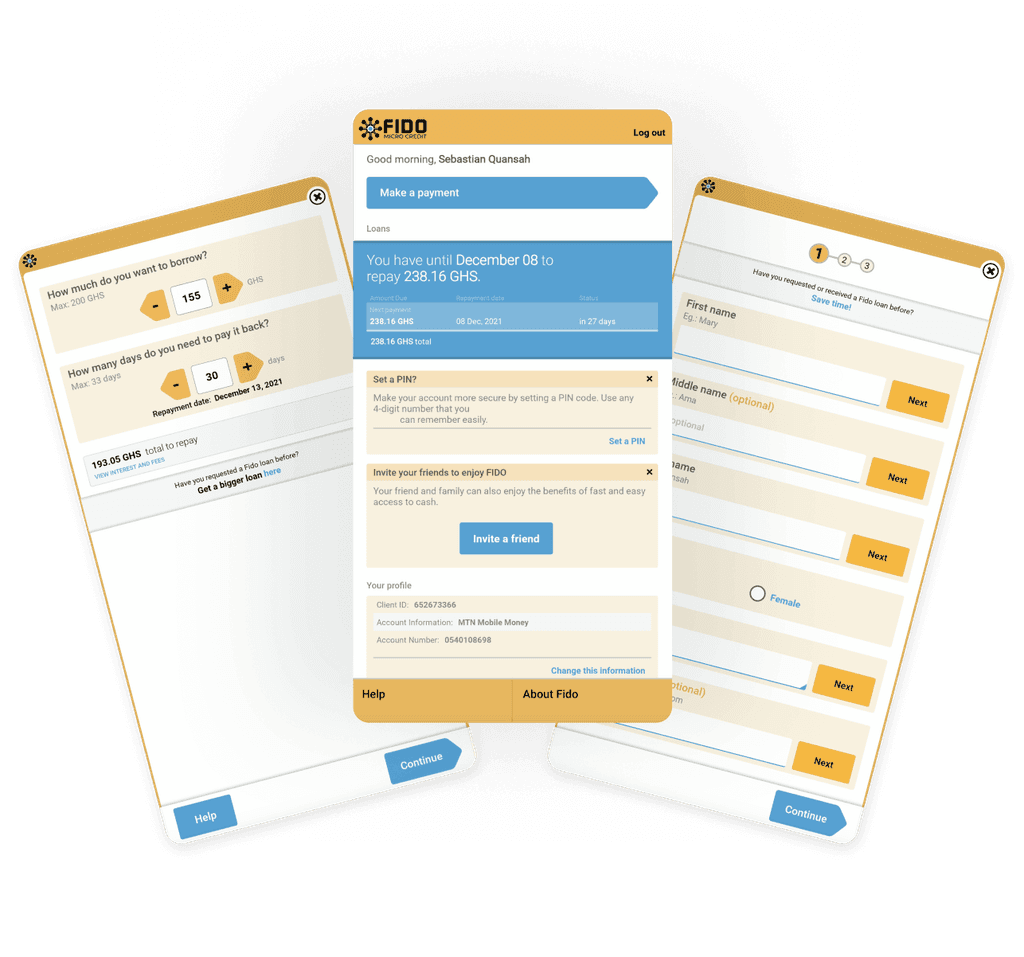

We were in a very strategic point where there was already an existing app with and a new and growing team that had just been recruited. The plan was to quickly grow and expand the product into a new evolved app with a substantial rebranding process.

The process started with a Design Sprint that kicked off on my first day at Fido.

We were in a very strategic point where there was already an existing app with and a new and growing team that had just been recruited. The plan was to quickly grow and expand the product into a new evolved app with a substantial rebranding process.

Old app design

Old app design

New app design

New app design

user research

user research

At the time, the app had 150,000 active users, We initiated the process by conducting user interviews and collaborating with representatives from the Ghanaian team, aiming to gain insights into their daily experiences. This allowed us to uncover unique challenges and discern disparities in both cultural practices and financial behaviors.

At the time, the app had 150,000 active users, We initiated the process by conducting user interviews and collaborating with representatives from the Ghanaian team, aiming to gain insights into their daily experiences. This allowed us to uncover unique challenges and discern disparities in both cultural practices and financial behaviors.

Key findings

Key findings

The unbanked reality

Since over 70% of the population does not own a bank account, their financial history is limited to non-existent, which blocks them from receiving basic financial services such as loans, savings, and insurance.

Use of Mobile Money wallets

In Africa, the most popular way to manage money is using a smartphone as a digital wallet. Mobile money is the go-to solution for easy fund transfers, bill payments, and purchases, all without the need for a traditional bank account.

The unbanked reality

Since over 70% of the population does not own a bank account, their financial history is limited to non-existent, which blocks them from receiving basic financial services such as loans, savings, and insurance.

Use of Mobile Money wallets

In Africa, the most popular way to manage money is using a smartphone as a digital wallet. Mobile money is the go-to solution for easy fund transfers, bill payments, and purchases, all without the need for a traditional bank account.

Distrust of traditional banks

Unbanked individuals often harbor distrust and negative perceptions of banks due to past experiences, including feeling undervalued, loan denials, and enduring lengthy and intrusive approval processes.

Accessible Mobile transactions

Funds are deposited and withdrawn from mobile wallets at stalls lining the streets of Ghana, offering a more accessible and popular choice than traditional banks, which are situated farther away and involve a lengthy, bureaucratic process.

Distrust of traditional banks

Unbanked individuals often harbor distrust and negative perceptions of banks due to past experiences, including feeling undervalued, loan denials, and enduring lengthy and intrusive approval processes.

Accessible Mobile transactions

Funds are deposited and withdrawn from mobile wallets at stalls lining the streets of Ghana, offering a more accessible and popular choice than traditional banks, which are situated farther away and involve a lengthy, bureaucratic process.

Advanced payments strain

Payments and bills are always paid in advance - electricity, data, water, and even rent is sometimes paid 2 years in advance, this reality causes a problem in which many times, already in the middle of the month, they run out of money.

Motivation for Financial Growth

Most of the population has a very high motivation to improve their financial state and achieve financial independence. It is very common to see people running a small business on the side in addition to their full-time job as an employee.

Advanced payments strain

Payments and bills are always paid in advance - electricity, data, water, and even rent is sometimes paid 2 years in advance, this reality causes a problem in which many times, already in the middle of the month, they run out of money.

Motivation for Financial Growth

Most of the population has a very high motivation to improve their financial state and achieve financial independence. It is very common to see people running a small business on the side in addition to their full-time job as an employee.

Bridging the gap

Bridging the gap

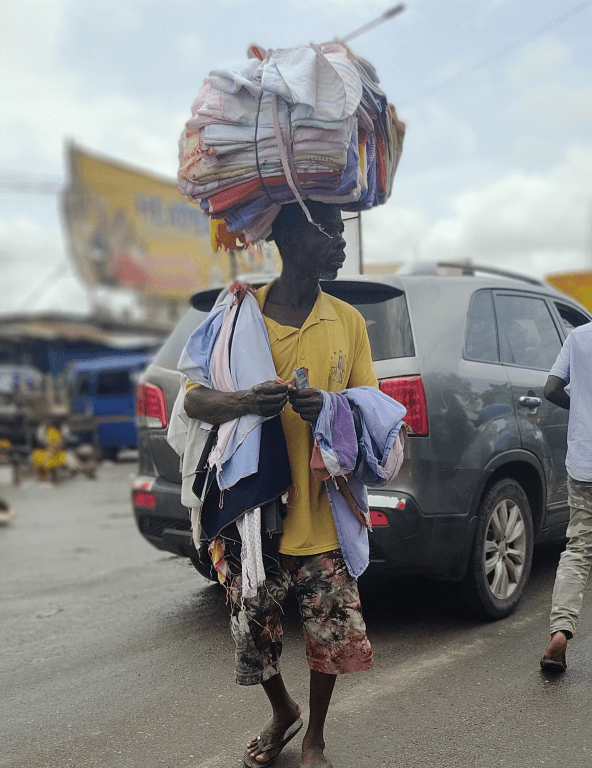

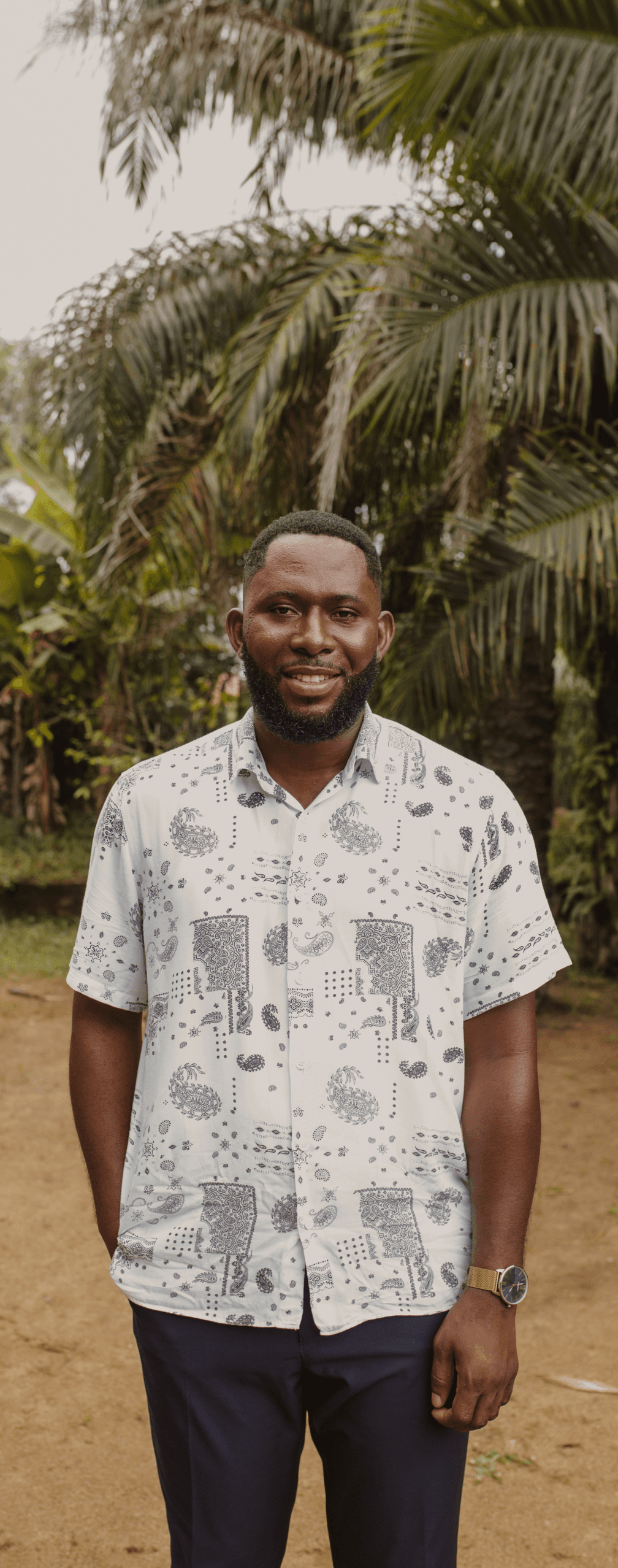

Recognizing the key to our product's success lies in understanding our users, I took a trip to Ghana just three weeks into my role at Fido. Conducting user testing sessions at our Ghanaian office, we aimed to gain firsthand insights into our users' experiences and challenges, ensuring our product aligns with their needs.

Recognizing the key to our product's success lies in understanding our users, I took a trip to Ghana just three weeks into my role at Fido. Conducting user testing sessions at our Ghanaian office, we aimed to gain firsthand insights into our users' experiences and challenges, ensuring our product aligns with their needs.

Testing the MVP prototype with users in Fido’s offices in Accra, Ghana.

Testing the MVP prototype with users in Fido’s offices in Accra, Ghana.

Small business owners selling produce and gadgets in the Sunday market. Accra, Ghana

People transferring money to their MoMo wallets at stalls lining the streets of Accra.

The Colorful and vibrant energy is seen in the peoples clothing and bustling streets.

People transferring money to their MoMo wallets at stalls lining the streets of Accra.

Small business owners selling produce and gadgets in the Sunday market. Accra, Ghana

Cultural immersion

Cultural immersion

Being in Ghana allowed us to immerse ourselves in the daily lives of our users, fostering a deeper connection and firsthand understanding of their needs and pain points, which greatly informed the design and development of our product.

Being in Ghana allowed us to immerse ourselves in the daily lives of our users, fostering a deeper connection and firsthand understanding of their needs and pain points, which greatly informed the design and development of our product.

User persona

User persona

Fido's persona embodies individuals in the lower-Mid income spectrum, often engaged in self-employment or side jobs, envisioning a future where their businesses grow and thrive.

Fido's persona embodies individuals in the lower-Mid income spectrum, often engaged in self-employment or side jobs, envisioning a future where their businesses grow and thrive.

Anthony Mensah

Self employed

Age:

31

Status:

Married +2

Education:

Primary schooling

Income:

Low-Mid range

Location:

Accra, Ghana

Attributes:

Hardworking, frugal, community oriented, responsible, persistent

Background

Anthony, a Ghanaian entrepreneur, juggles a day job as a customer service representative with running a fresh produce stall in the local market during nights and weekends. As the primary breadwinner for his family, Anthony is determined to overcome financial challenges and provide a better life for his family.

"Balancing rent, bills, and daily needs is a constant concern. I'm determined to secure a stable financial future for my family."

Goals & Motivations

Financial Stability: securing a consistent income from his stall, ensuring his family's basic needs are met without constant financial stress

Business Growth: expanding his stall, attract more customers, and increase revenue

Children's Education: providing them with a good education, and better opportunities than he had

Challenges

Balancing rent, utility bills, and ensuring there's enough food on the table

Fears financial limitations might hinder his children's education and opportunities

Lack of a stable income raises concerns about healthcare expenses, especially in emergencies.

Worries about the long-term sustainability of his stall business.

Behaviors

Smartphone: Android User

Unable to Access Credit from Banks

Preferred Payment Method: Mobile Money (MoMo)

Apps: Regularly Uses Fido for Loans, WhatsApp, Facebook, Twitter

Cautious about Data Usage

Enjoys Watching Soccer Matches, Attends Church on Sundays, Enjoys Free TV, Socializes at Bars with Friends

Anthony Mensah

Self employed

Background

Anthony, a Ghanaian entrepreneur, juggles a day job as a customer service representative with running a fresh produce stall in the local market during nights and weekends. As the primary breadwinner for his family, Anthony is determined to overcome financial challenges and provide a better life for his family.

Age:

31

Status:

Married +2

Education:

Primary schooling

Income:

Low-Mid range

Location:

Accra, Ghana

Hardworking, frugal, community oriented, responsible, persistent

"Balancing rent, bills, and daily needs is a constant concern. I'm determined to secure a stable financial future for my family."

Goals & motivations

Financial Stability: securing a consistent income from his stall, ensuring his family's basic needs are met without constant financial stress

Business Growth: expanding his stall, attract more customers, and increase revenue

Children's Education: providing them with a good education, and better opportunities than he had

Challenges

Balancing rent, utility bills, and ensuring there's enough food on the table

Fears financial limitations might hinder his children's education and opportunities

Lack of a stable income raises concerns about healthcare expenses, especially in emergencies.

Worries about the long-term sustainability of his stall business.

Behaviors

Smartphone: Android User

Unable to Access Credit from Banks

Preferred Payment Method: Mobile Money (MoMo)

Apps: Regularly Uses Fido for Loans, WhatsApp, Facebook, Twitter

Cautious about Data Usage

Enjoys Watching Soccer Matches, Attends Church on Sundays, Enjoys Free TV, Socializes at Bars with Friends

Analysis &

design opportunities

When approaching the redesign process we put a large emphasis on improving the user experience while preserving the unique capabilities of the product. We began by mapping out flows in the app, prioritizing the ones that we need to improve first.

Analysis &

design opportunities

When approaching the redesign process we put a large emphasis on improving the user experience while preserving the unique capabilities of the product. We began by mapping out flows in the app, prioritizing the ones that we need to improve first.

Analysis &

design opportunities

When approaching the redesign process we put a large emphasis on improving the user experience while preserving the unique capabilities of the product. We began by mapping out flows in the app, prioritizing the ones that we need to improve first.

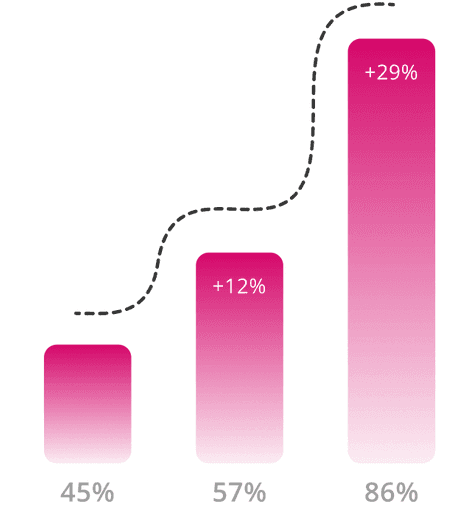

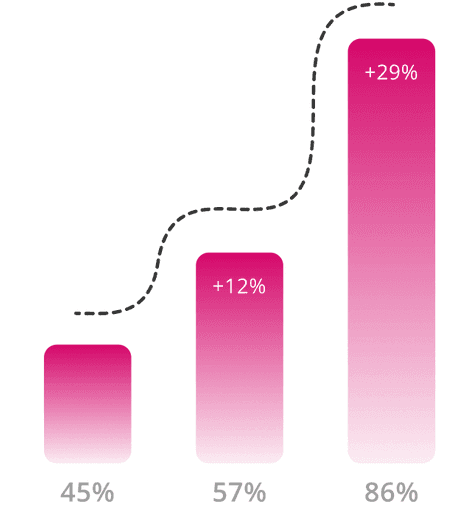

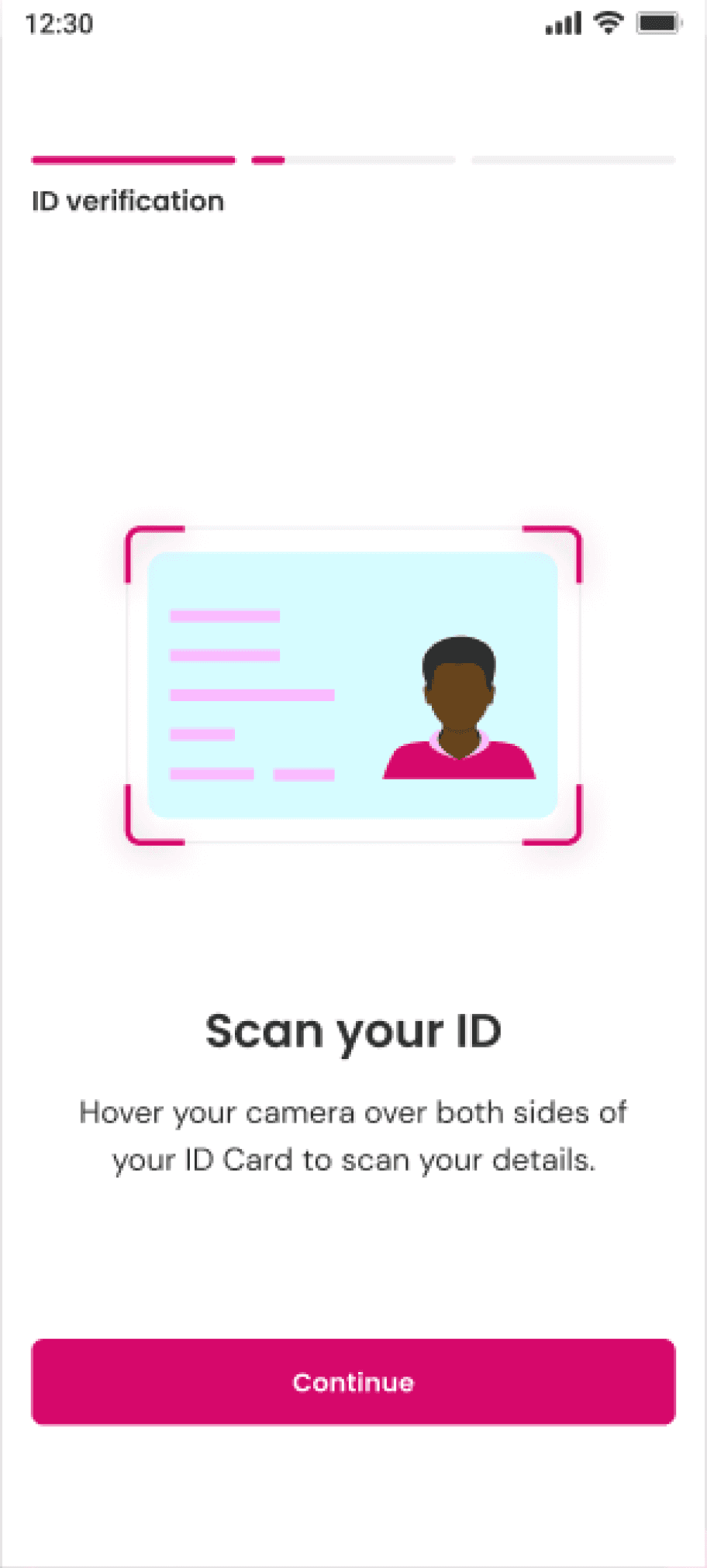

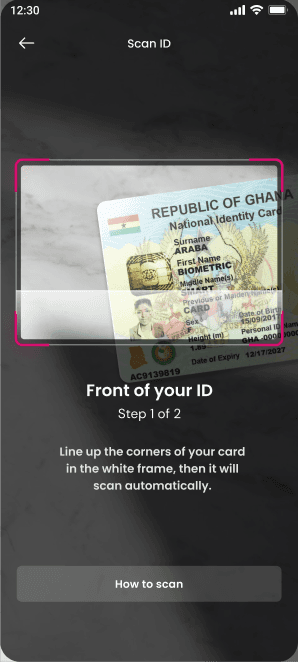

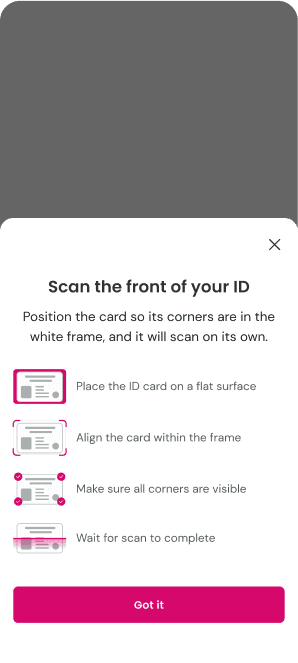

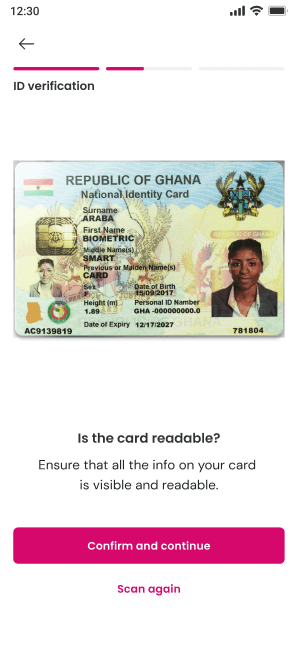

Opportunity #1

Opportunity #1

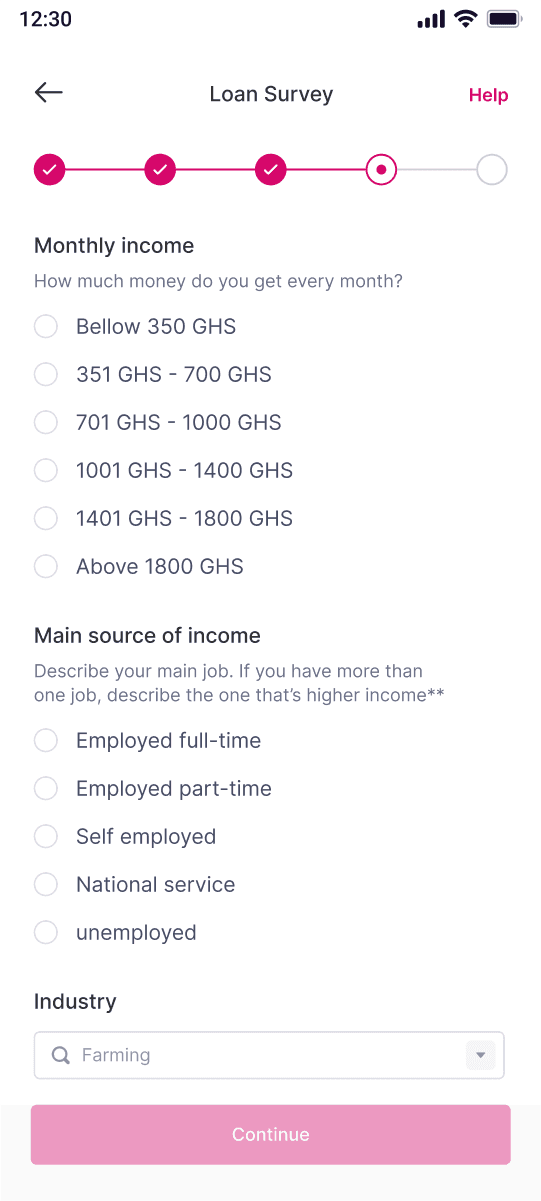

Challenge

Challenge

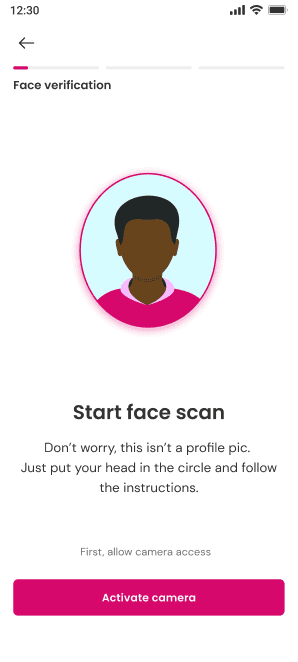

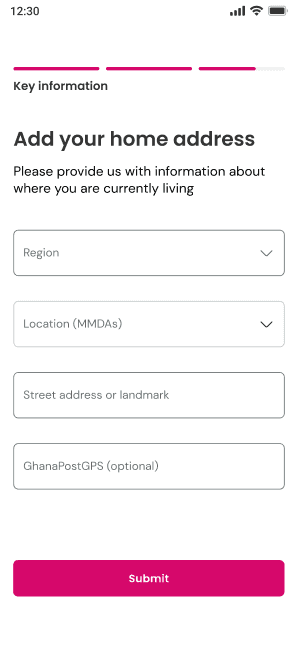

Enhancing user verification: tackling a 45% conversion rate

Enhancing user verification: tackling a 45% conversion rate

The problem

The problem

Over half of users faced difficulties completing the verification process, resulting in a 45% conversion rate. The most significant drop occurred during the liveliness stage, with users spending up to 10 minutes attempting to follow multiple on-screen directions while the app struggled to verify their faces.

Over half of users faced difficulties completing the verification process, resulting in a 45% conversion rate. The most significant drop occurred during the liveliness stage, with users spending up to 10 minutes attempting to follow multiple on-screen directions while the app struggled to verify their faces.

Root cause

Root cause

After conducting user testing in Ghana with the actual app, we pinpointed the root cause as a technical issue:

The verification model's inadequacy, particularly its struggle to accurately recognize dark-skinned users. Despite our prior in-depth research on verification models to mitigate this issue, the selected model, designed to adapt to darker skin colors, still fell short in verifying our users correctly.

Other identified issues encompassed users struggling with the lengthy and fast-paced instructions and the constraint posed by low-quality cameras on local phones.

After conducting user testing in Ghana with the actual app, we pinpointed the root cause as a technical issue:

The verification model's inadequacy, particularly its struggle to accurately recognize dark-skinned users. Despite our prior in-depth research on verification models to mitigate this issue, the selected model, designed to adapt to darker skin colors, still fell short in verifying our users correctly.

Other identified issues encompassed users struggling with the lengthy and fast-paced instructions and the constraint posed by low-quality cameras on local phones.

Solutions

Solutions

Streamlined verification process

Streamlined verification process

Streamlined verification process

Reduced user actions to a single simple step – smiling during the face verification process.

Reduced user actions to a single simple step – smiling during the face verification process.

Reduced user actions to a single simple step – smiling during the face verification process.

Local smartphone adaptation

Local smartphone adaptation

Local smartphone adaptation

Implemented technical adjustments to accommodate local smartphone models,

Implemented technical adjustments to accommodate local smartphone models,

Implemented technical adjustments to accommodate local smartphone models,

Facial recognition model enhancement

Facial recognition model enhancement

Facial recognition model enhancement

Improved facial recognition by incorporating a different library for accurate recognition of darker-skinned users.

Improved facial recognition by incorporating a different library for accurate recognition of darker-skinned users.

Improved facial recognition by incorporating a different library for accurate recognition of darker-skinned users.

Outcomes

Outcomes

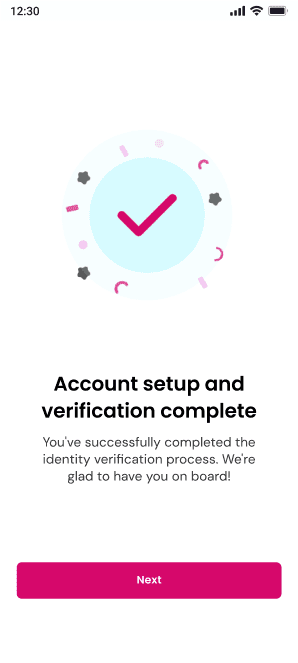

Outstanding 86% conversion rate reached

Outstanding 86% conversion rate reached

12% Conversion increase with Simplified Instructions

12% Conversion increase with Simplified Instructions

Reducing the instructions to a single step resulted in an immediate 12% increase in the conversion rate following the new version's release.

Reducing the instructions to a single step resulted in an immediate 12% increase in the conversion rate following the new version's release.

29% Conversion increase as result of technical enhancements

29% Conversion increase as result of technical enhancements

After making technical adjustments and improving the facial recognition model, the KYC flow achieved an impressive 86% conversion rate, highlighting the impact of these enhancements.

After making technical adjustments and improving the facial recognition model, the KYC flow achieved an impressive 86% conversion rate, highlighting the impact of these enhancements.

Designs

Designs

Final KYC screens

Final KYC screens

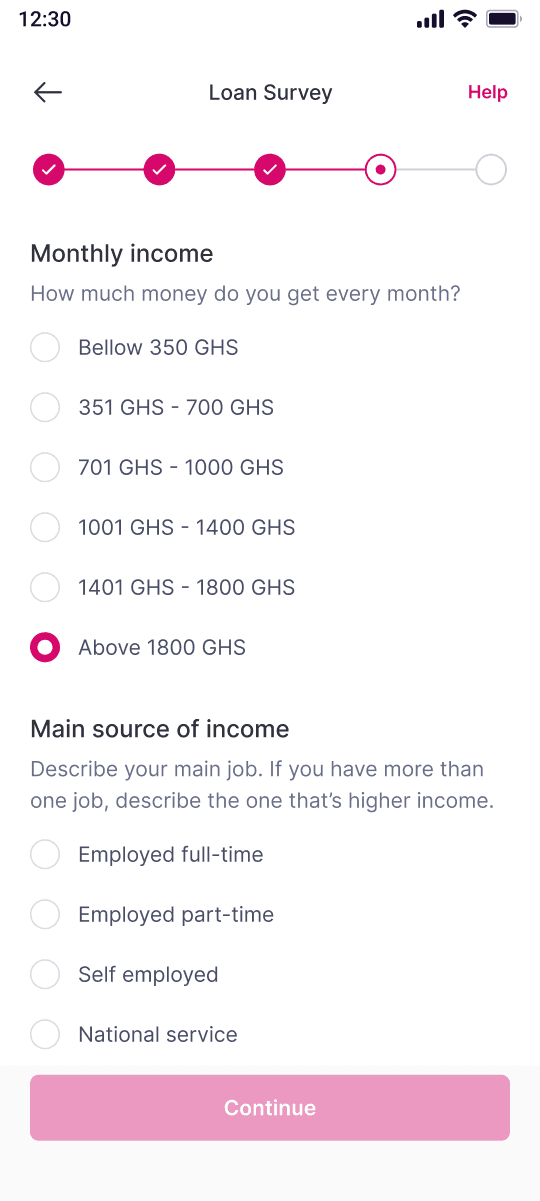

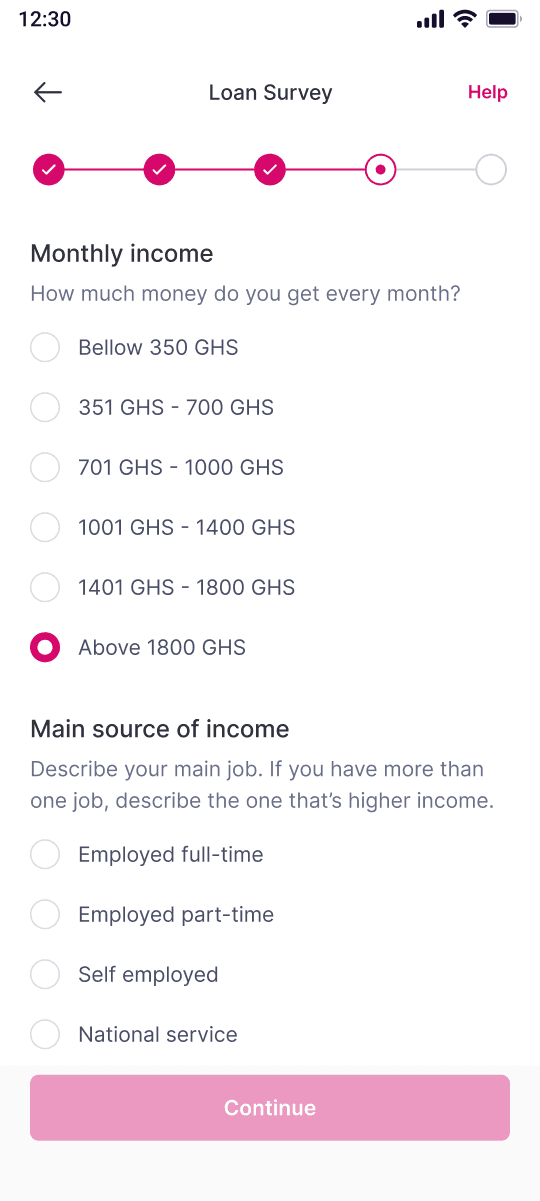

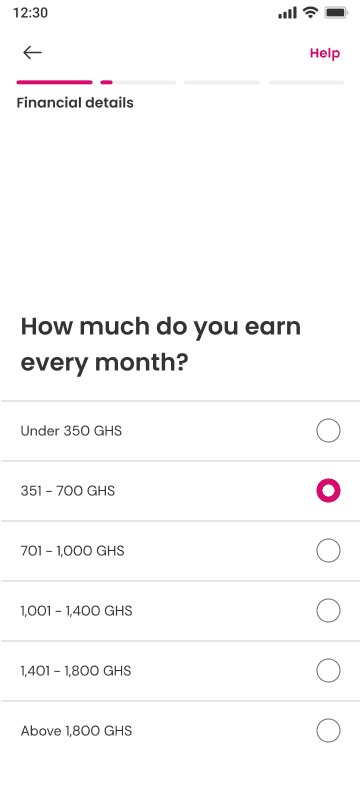

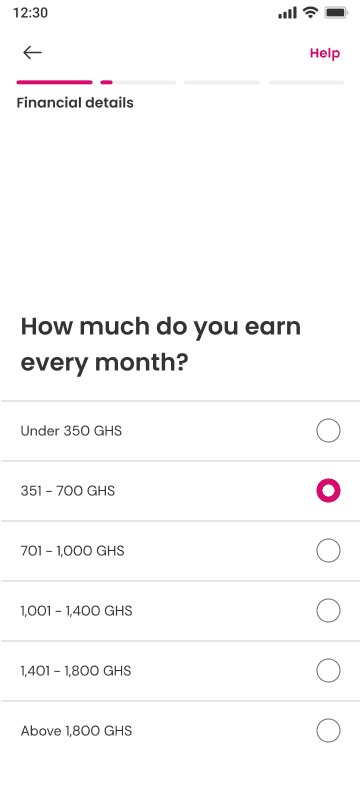

Opportunity #2

Opportunity #2

Challenge

Challenge

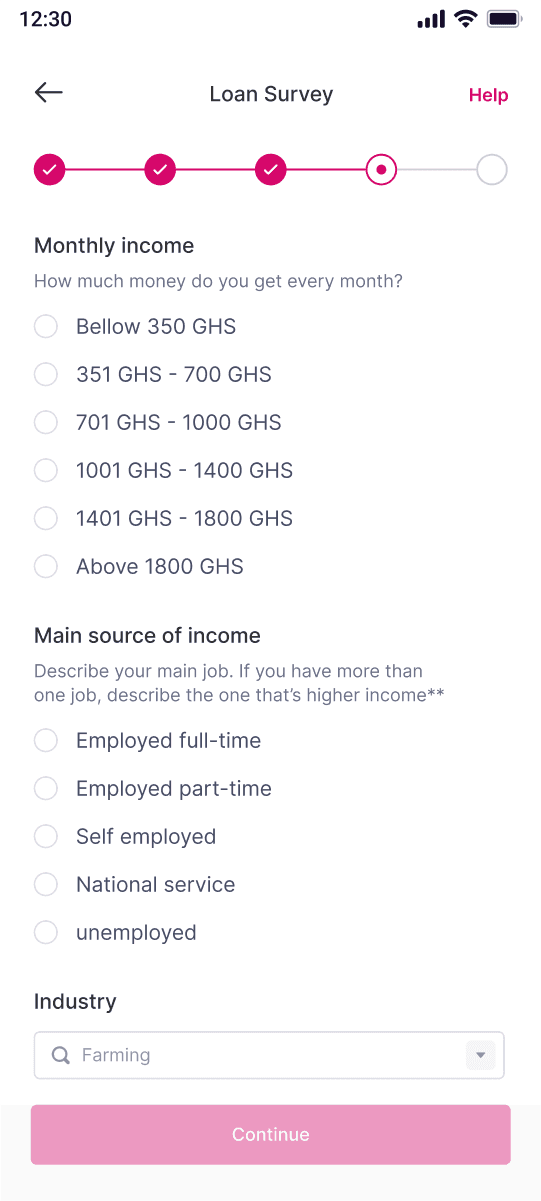

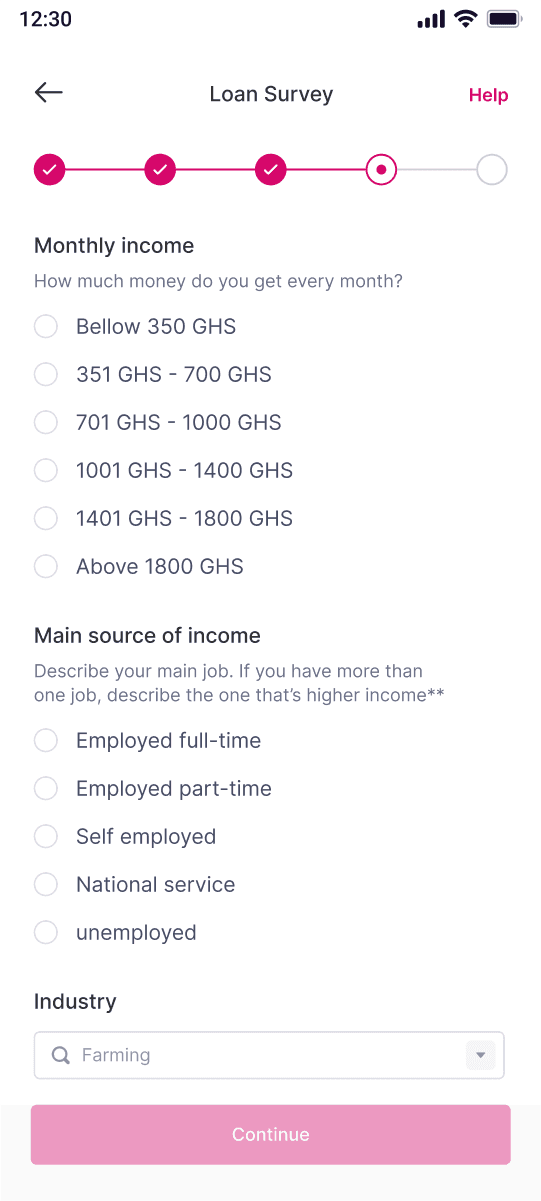

Usability Challenges: Navigating Larger Hand Sizes in Interface Interaction

Usability Challenges: Navigating Larger Hand Sizes in Interface Interaction

The problem

The problem

Physiological differences, specifically larger hand sizes among the target users, created difficulties in seamlessly using the interface.

Physiological differences, specifically larger hand sizes among the target users, created difficulties in seamlessly using the interface.

Root cause

Root cause

The issue was discovered during a user testing session in Ghana where we observed that the interface, particularly the credit draw and survey flow, posed challenges for users. This led to the recognition that physiological differences, specifically larger hand sizes among the users, made it difficult for them to tap on standard size input fields and buttons.

The issue was discovered during a user testing session in Ghana where we observed that the interface, particularly the credit draw and survey flow, posed challenges for users. This led to the recognition that physiological differences, specifically larger hand sizes among the users, made it difficult for them to tap on standard size input fields and buttons.

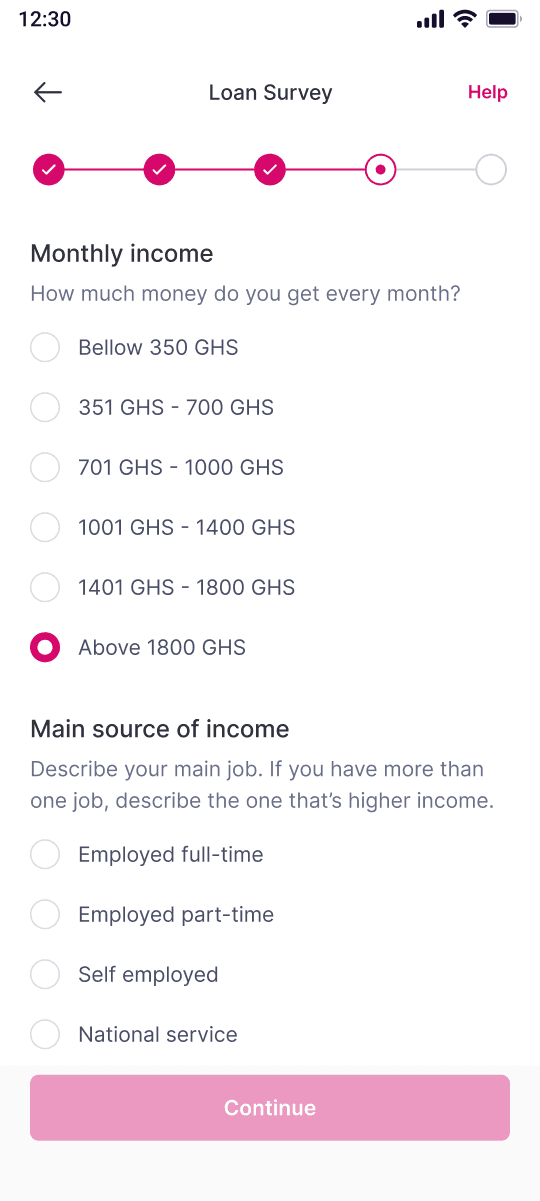

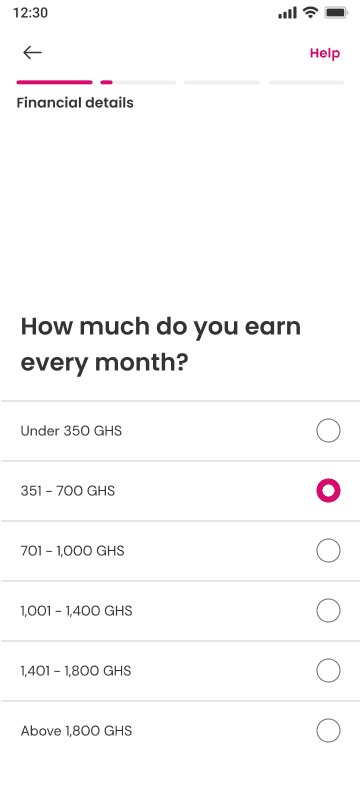

Solutions

Solutions

User-Centric Field Optimization

User-Centric Field Optimization

User-Centric Field Optimization

Adjusted the survey layout by enlarging and spacing out fields to accommodate larger hand sizes, providing a more comfortable and accessible interaction.

Adjusted the survey layout by enlarging and spacing out fields to accommodate larger hand sizes, providing a more comfortable and accessible interaction.

Adjusted the survey layout by enlarging and spacing out fields to accommodate larger hand sizes, providing a more comfortable and accessible interaction.

Sequential questionnaire screens

Sequential questionnaire screens

Sequential questionnaire screens

Restructured the survey flow, presenting each question on a separate screen, and enlarged questions and answer options for improved user engagement.

Restructured the survey flow, presenting each question on a separate screen, and enlarged questions and answer options for improved user engagement.

Restructured the survey flow, presenting each question on a separate screen, and enlarged questions and answer options for improved user engagement.

Outcomes

Outcomes

Enhanced User Interaction and Efficiency

Enhanced User Interaction and Efficiency

Streamlined User Flow

Streamlined User Flow

Users navigated through the flow quickly and easily, enhancing overall usability by eliminating the need for scrolling.

Users navigated through the flow quickly and easily, enhancing overall usability by eliminating the need for scrolling.

Reduced Cognitive Load

Reduced Cognitive Load

Users experienced less mental strain while navigating the streamlined survey, leading to improved comprehension.

Users experienced less mental strain while navigating the streamlined survey, leading to improved comprehension.

Perceived Shortness

Perceived Shortness

Users reported the survey seemed shorter, contributing to a perceived reduction in length.

Users reported the survey seemed shorter, contributing to a perceived reduction in length.

Reduced Question Perception

Reduced Question Perception

Users believed there were fewer questions, indicating an improved user experience.

Users believed there were fewer questions, indicating an improved user experience.

Designs

Designs

Survey evolution

Survey evolution

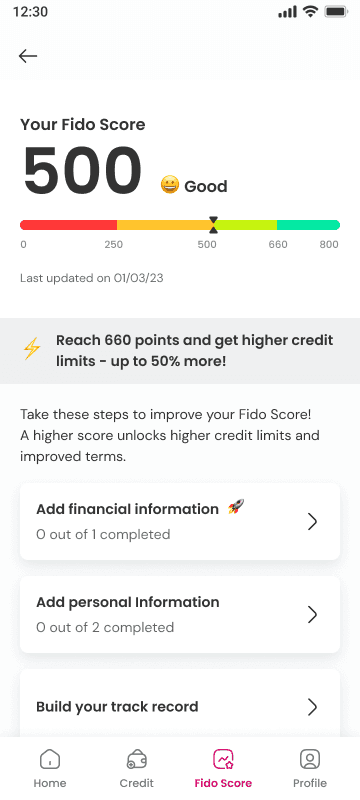

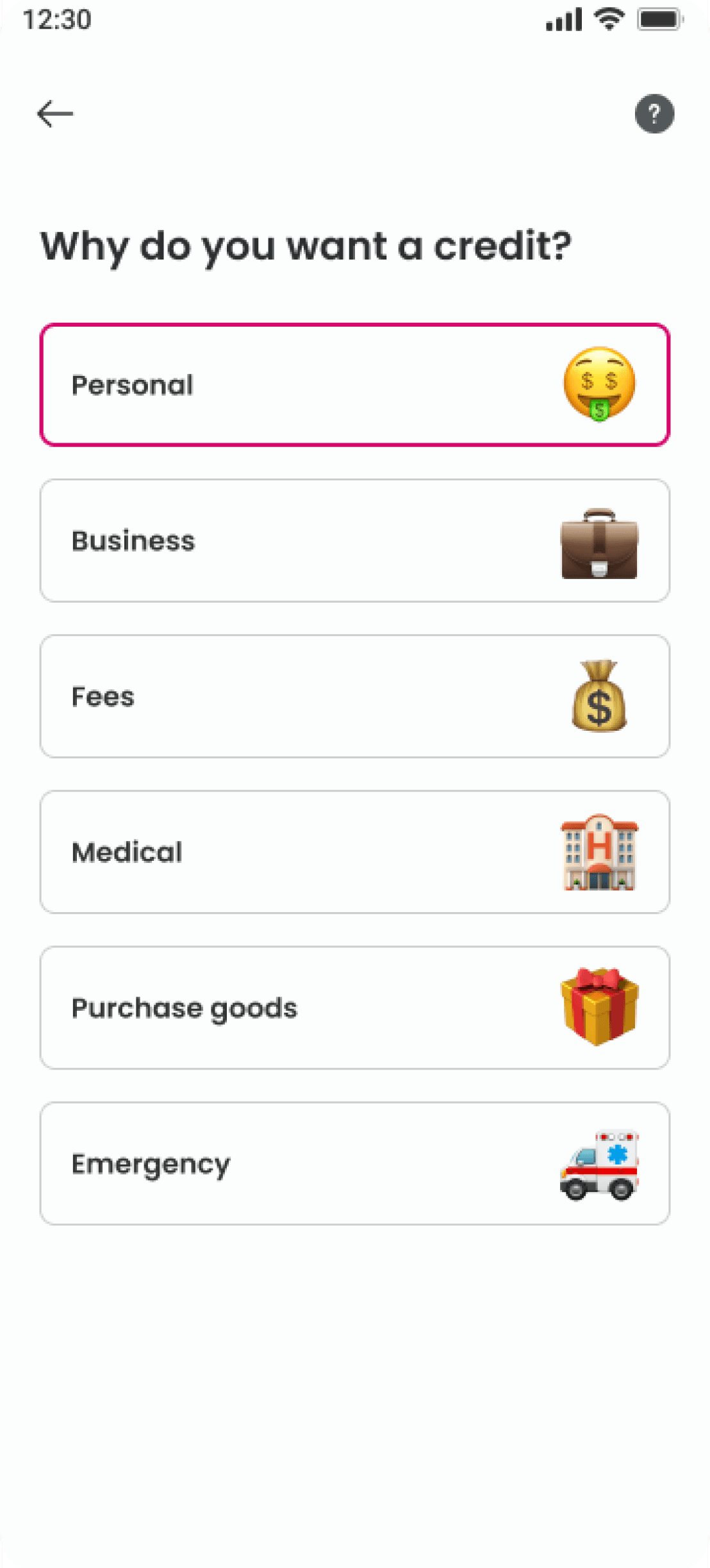

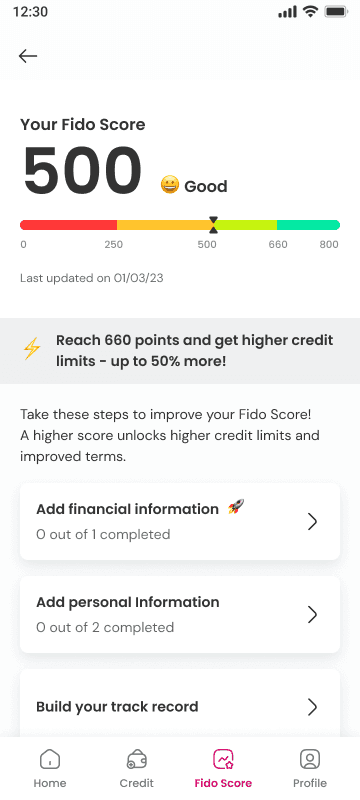

Opportunity #3

Opportunity #3

Challenge

Challenge

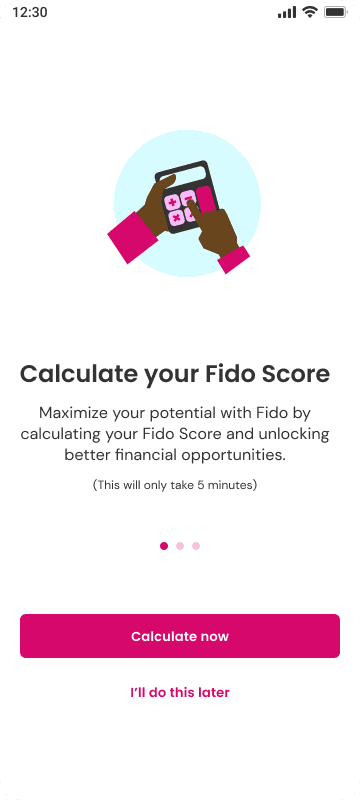

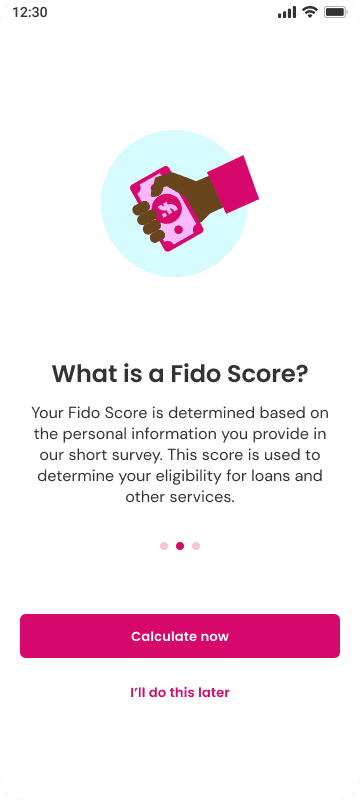

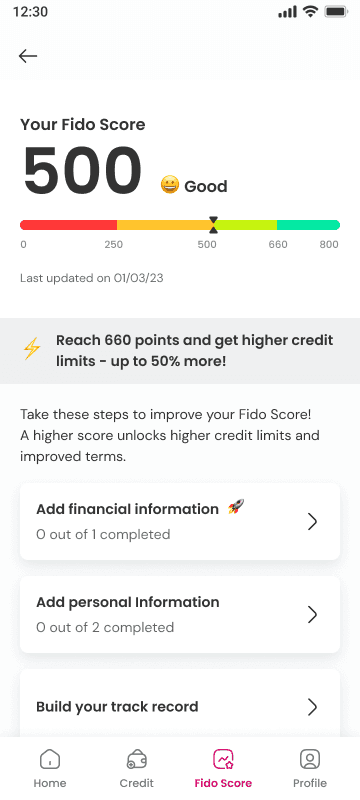

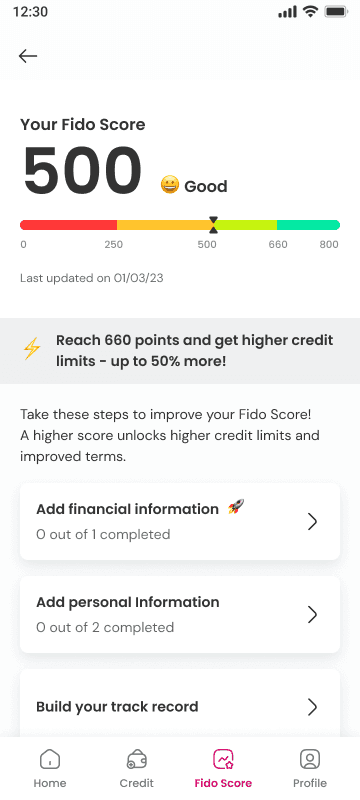

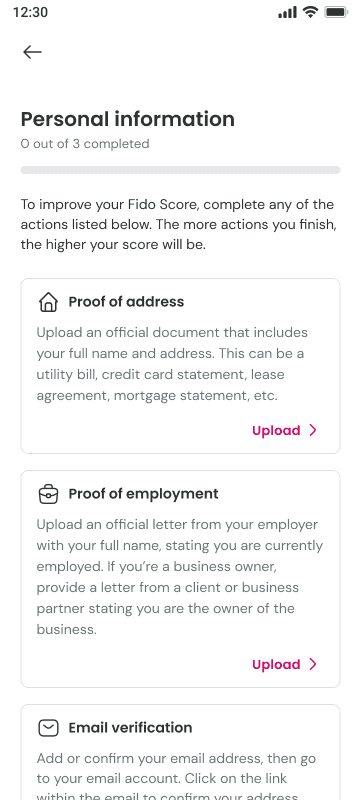

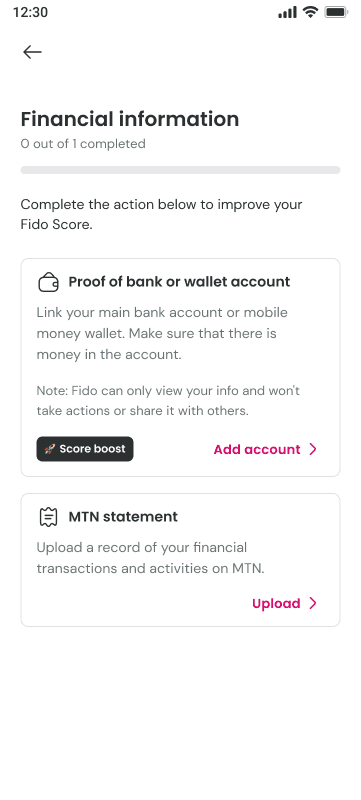

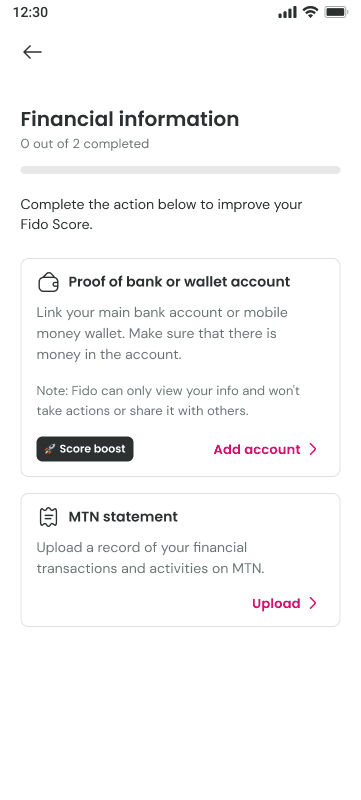

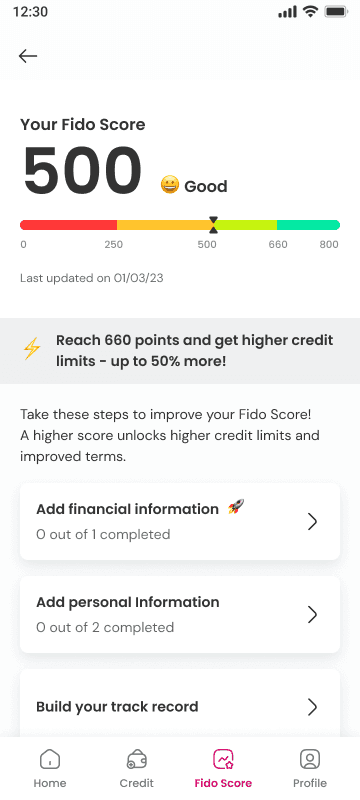

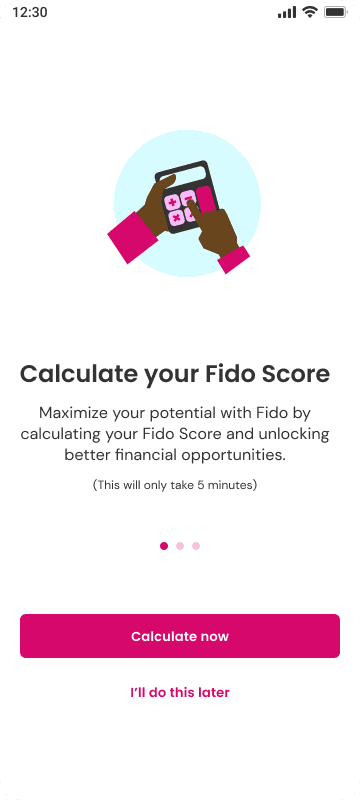

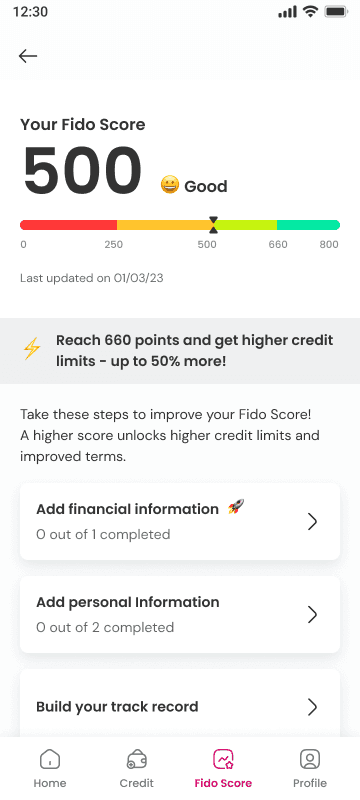

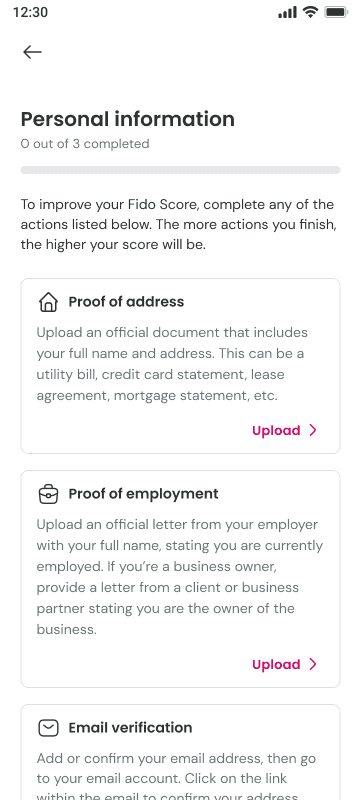

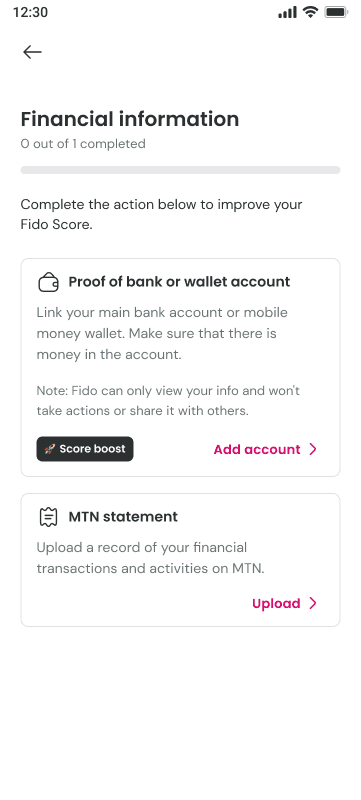

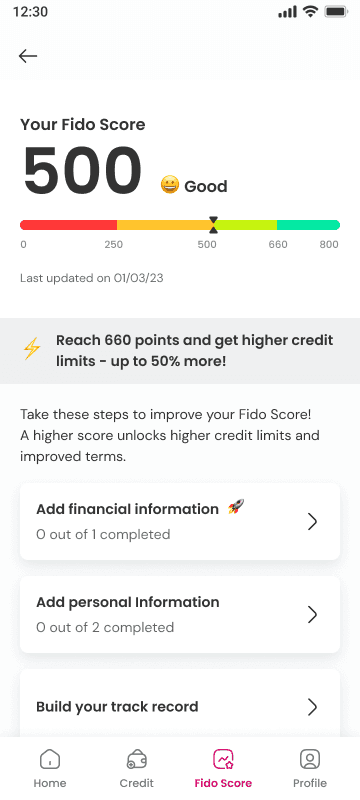

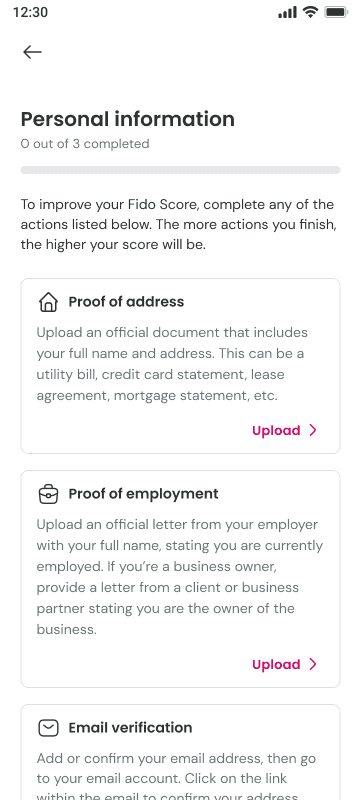

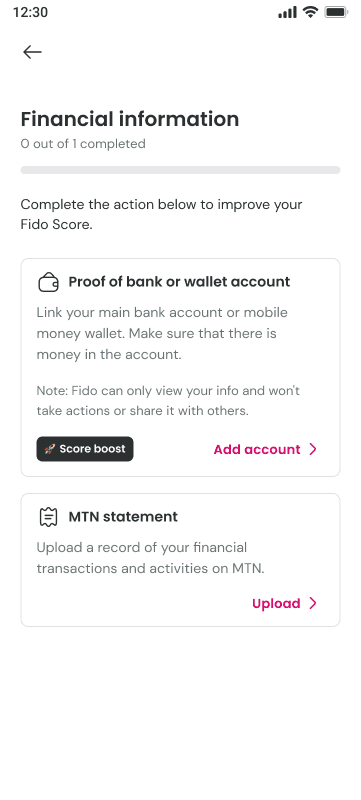

Understanding Fido Score: Bridging Financial Literacy Gaps

Understanding Fido Score: Bridging Financial Literacy Gaps

Users' lack of a financial record creates challenges in assessing credit risk and delivering tailored services. Additionally, their limited financial education and understanding of the Fido Score concept hinder their motivation to calculate and enhance their scores.

Users' lack of a financial record creates challenges in assessing credit risk and delivering tailored services. Additionally, their limited financial education and understanding of the Fido Score concept hinder their motivation to calculate and enhance their scores.

Solutions

Solutions

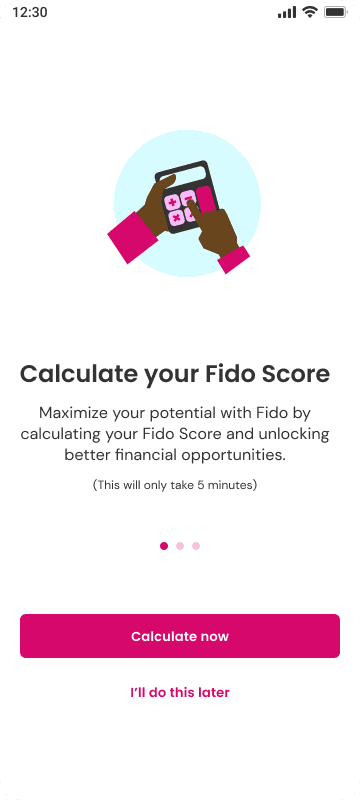

Walkthrough process

Walkthrough process

Walkthrough process

Guide users to calculate and enhance their Fido Score with step-by-step instructions and engaging incentives.

Guide users to calculate and enhance their Fido Score with step-by-step instructions and engaging incentives.

Guide users to calculate and enhance their Fido Score with step-by-step instructions and engaging incentives.

User understanding

User understanding

User understanding

Improve understanding by providing clear information on what a Fido Score is, how to improve it, and the associated benefits.

Improve understanding by providing clear information on what a Fido Score is, how to improve it, and the associated benefits.

Improve understanding by providing clear information on what a Fido Score is, how to improve it, and the associated benefits.

Clarity and simplicity

Clarity and simplicity

Clarity and simplicity

Ensure transparency and simplicity in presenting the Fido Score and the associated process, making it clear and simple for users.

Ensure transparency and simplicity in presenting the Fido Score and the associated process, making it clear and simple for users.

Ensure transparency and simplicity in presenting the Fido Score and the associated process, making it clear and simple for users.

Designs

Designs

Fido Score screens

Fido Score screens

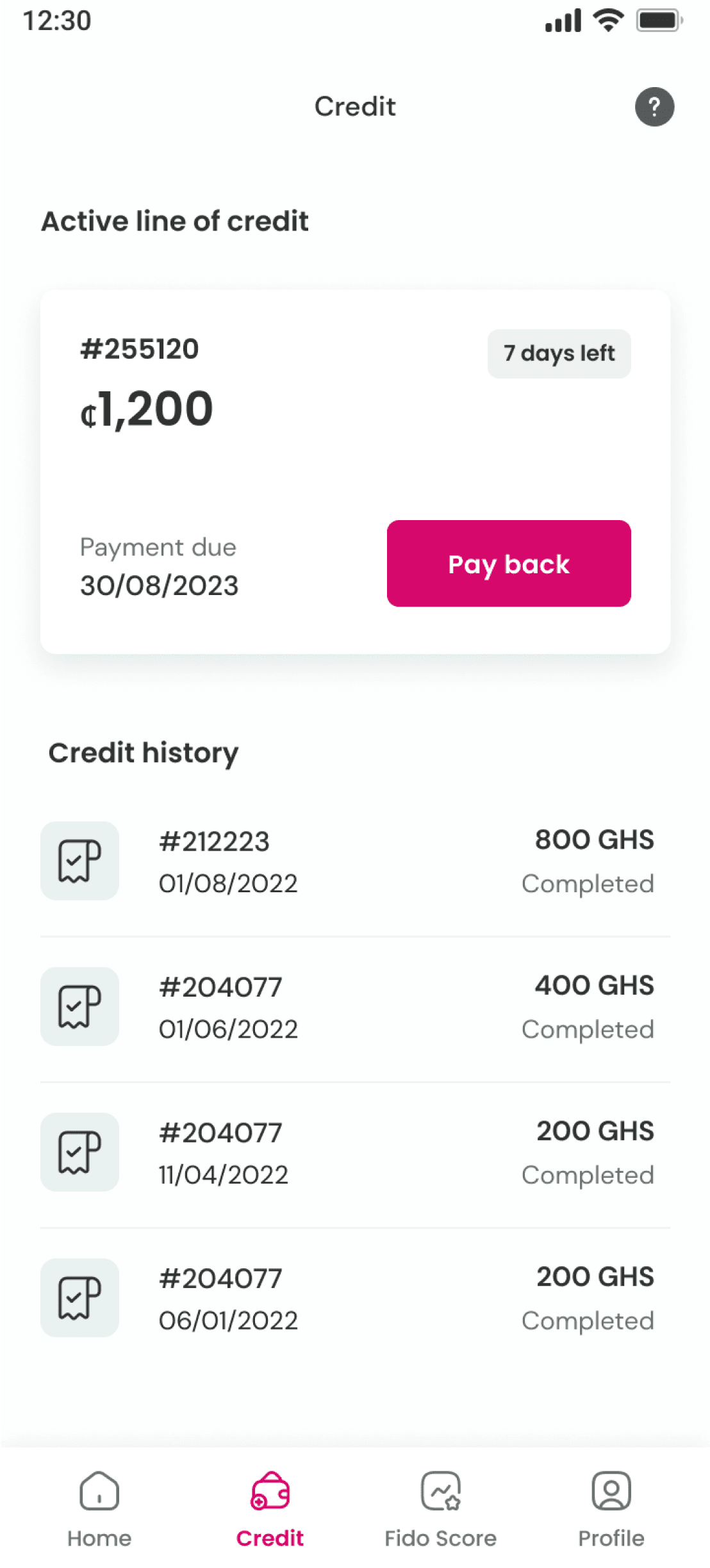

Opportunity #4

Opportunity #4

Challenge

Challenge

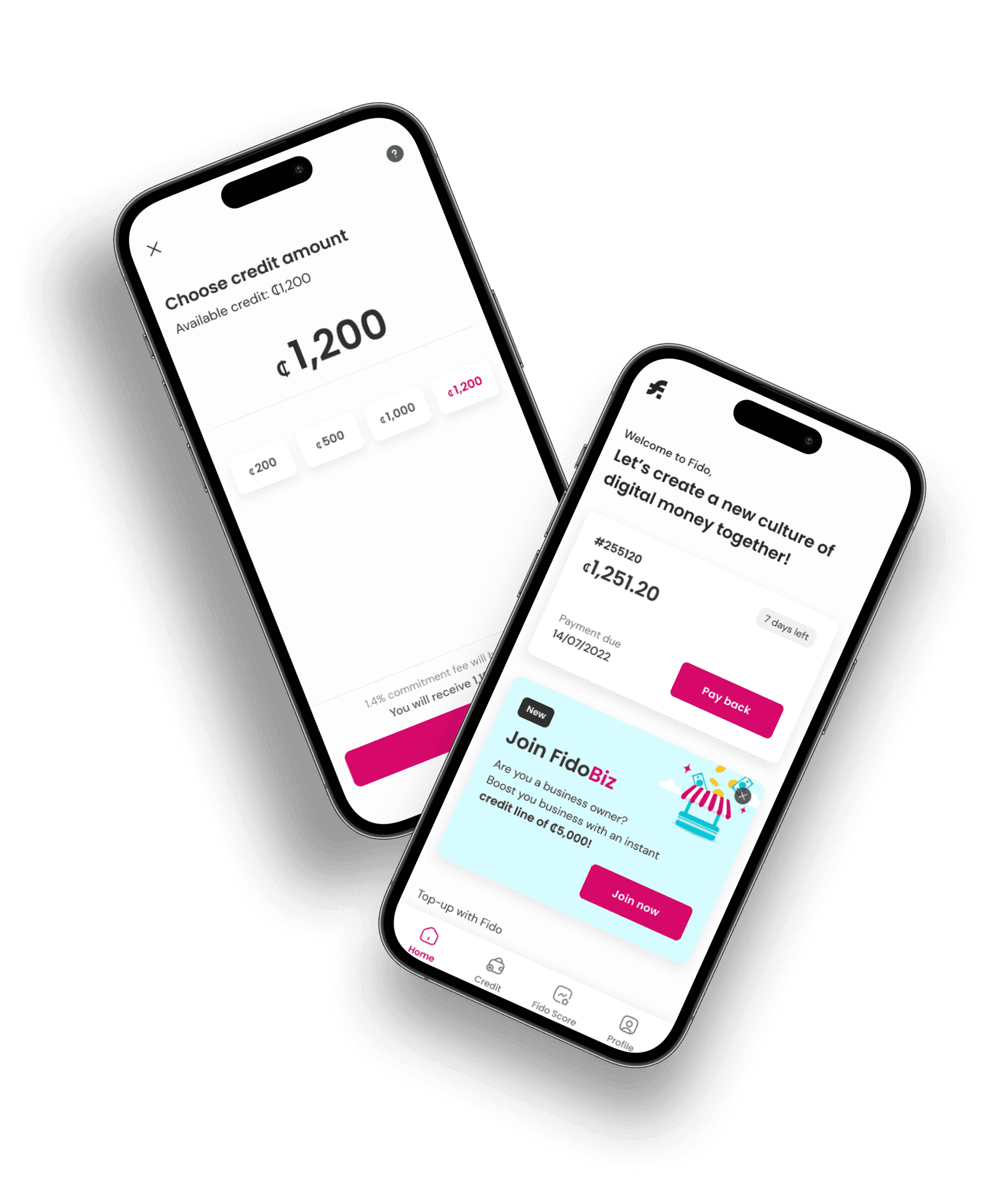

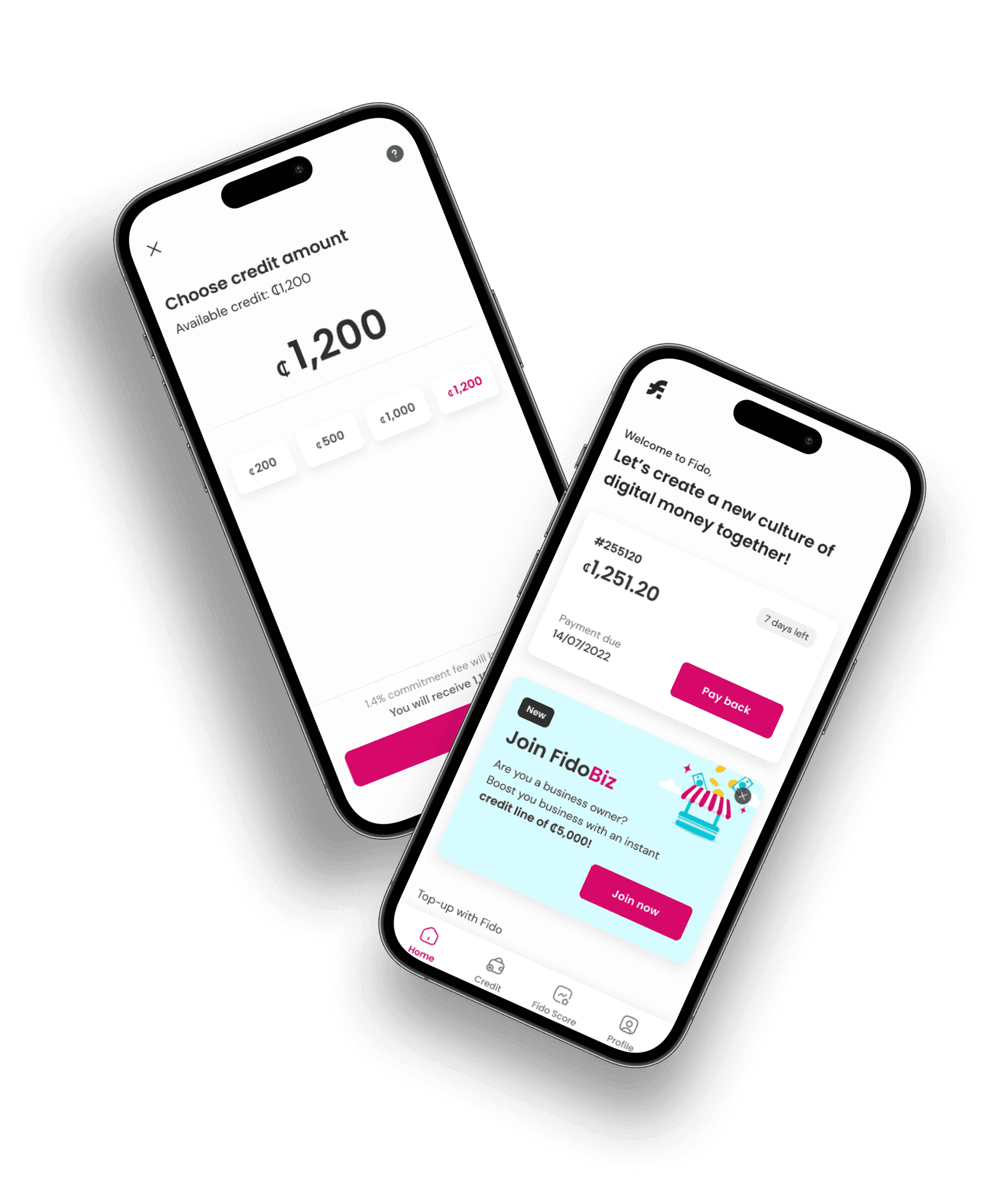

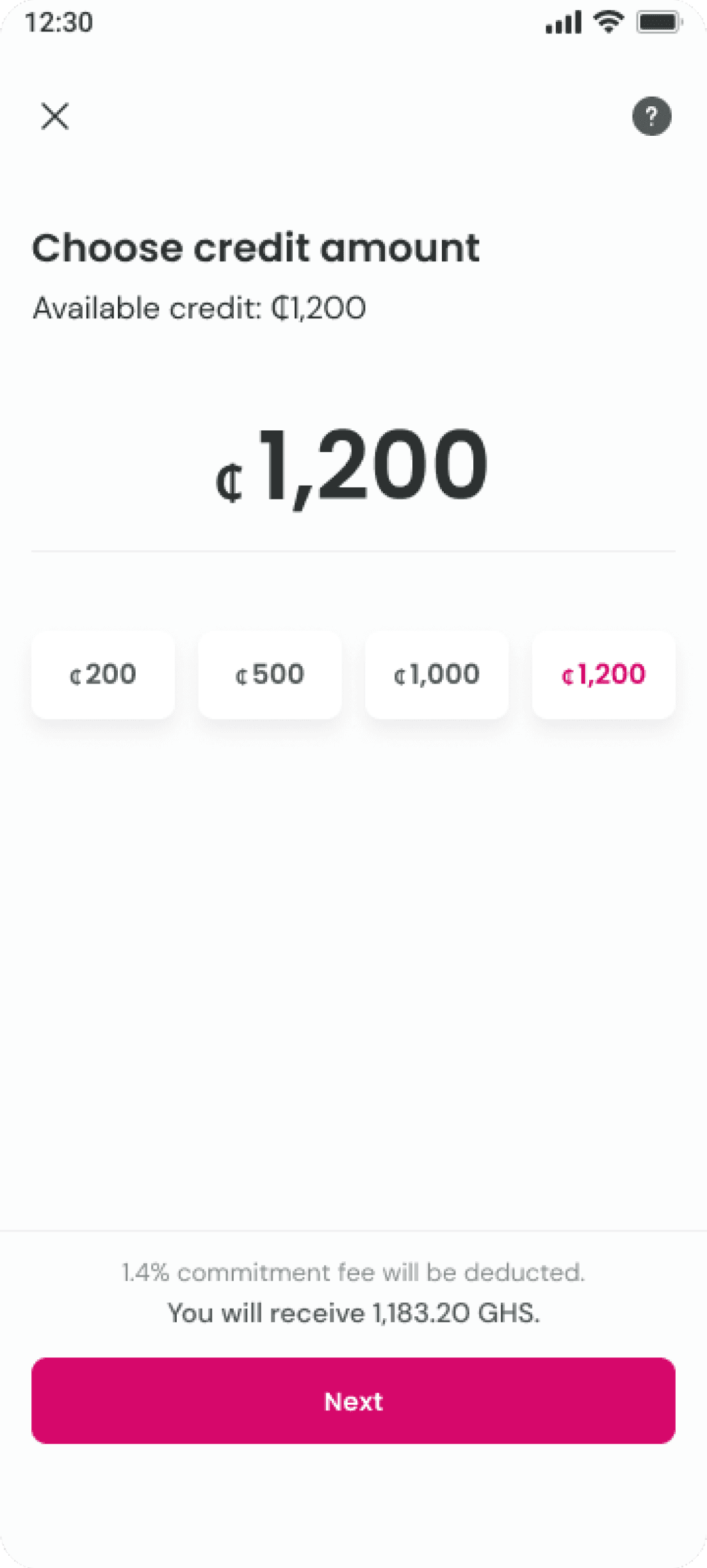

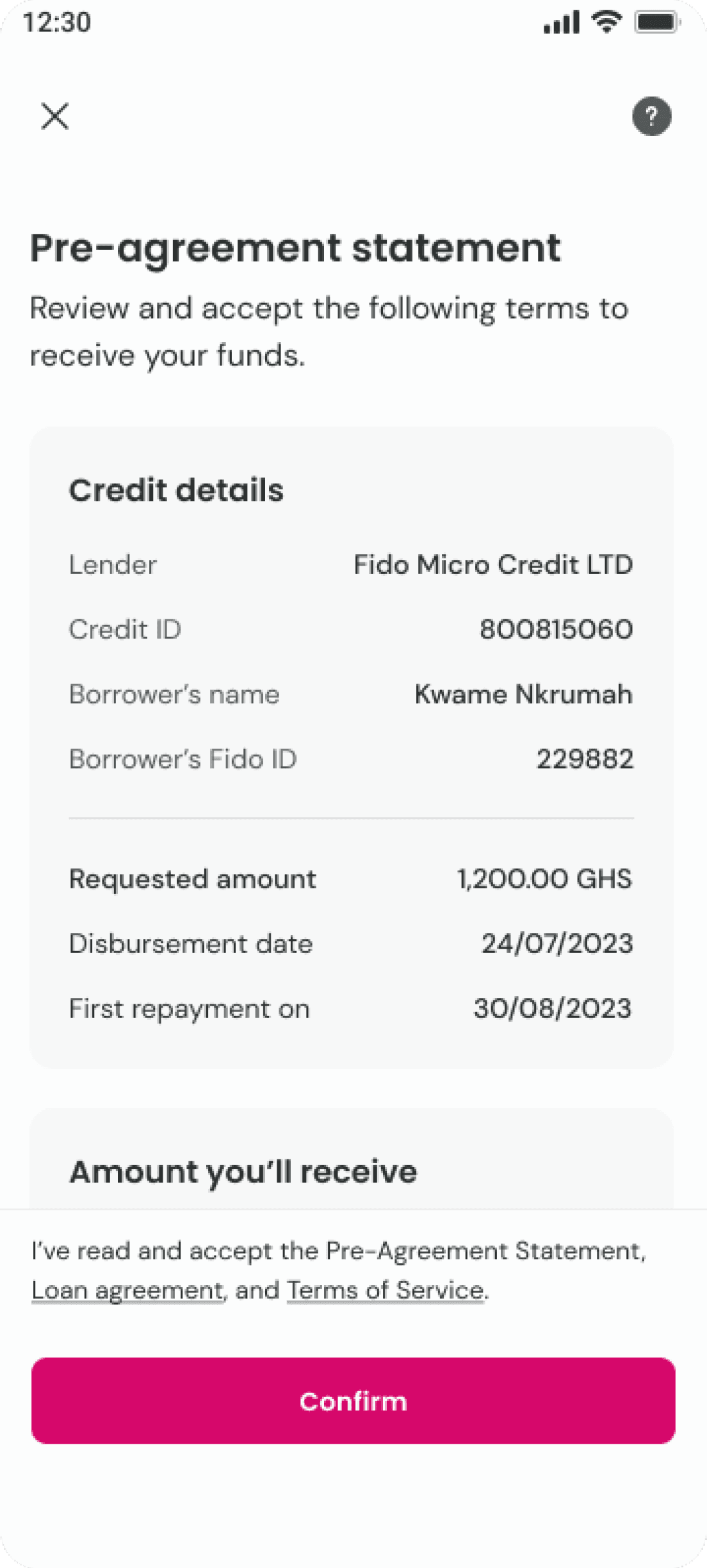

Elevating User Experience in Credit Draw Flow

Elevating User Experience in Credit Draw Flow

The problem

The problem

The credit draw flow presented a significant challenge with its outdated interface and poor user experience. Users faced challenges navigating through a intricate and disorganized process, resulting in frustration and the risk of disengagement.

The credit draw flow presented a significant challenge with its outdated interface and poor user experience. Users faced challenges navigating through a intricate and disorganized process, resulting in frustration and the risk of disengagement.

Opportunity

Opportunity

Recognizing the shortcomings in the existing credit draw flow, this presented a valuable opportunity for a comprehensive redesign. By updating the UX and interface, we strove to create a seamless and user-friendly experience, boosting satisfaction and engagement.

Recognizing the shortcomings in the existing credit draw flow, this presented a valuable opportunity for a comprehensive redesign. By updating the UX and interface, we strove to create a seamless and user-friendly experience, boosting satisfaction and engagement.

Solutions

Solutions

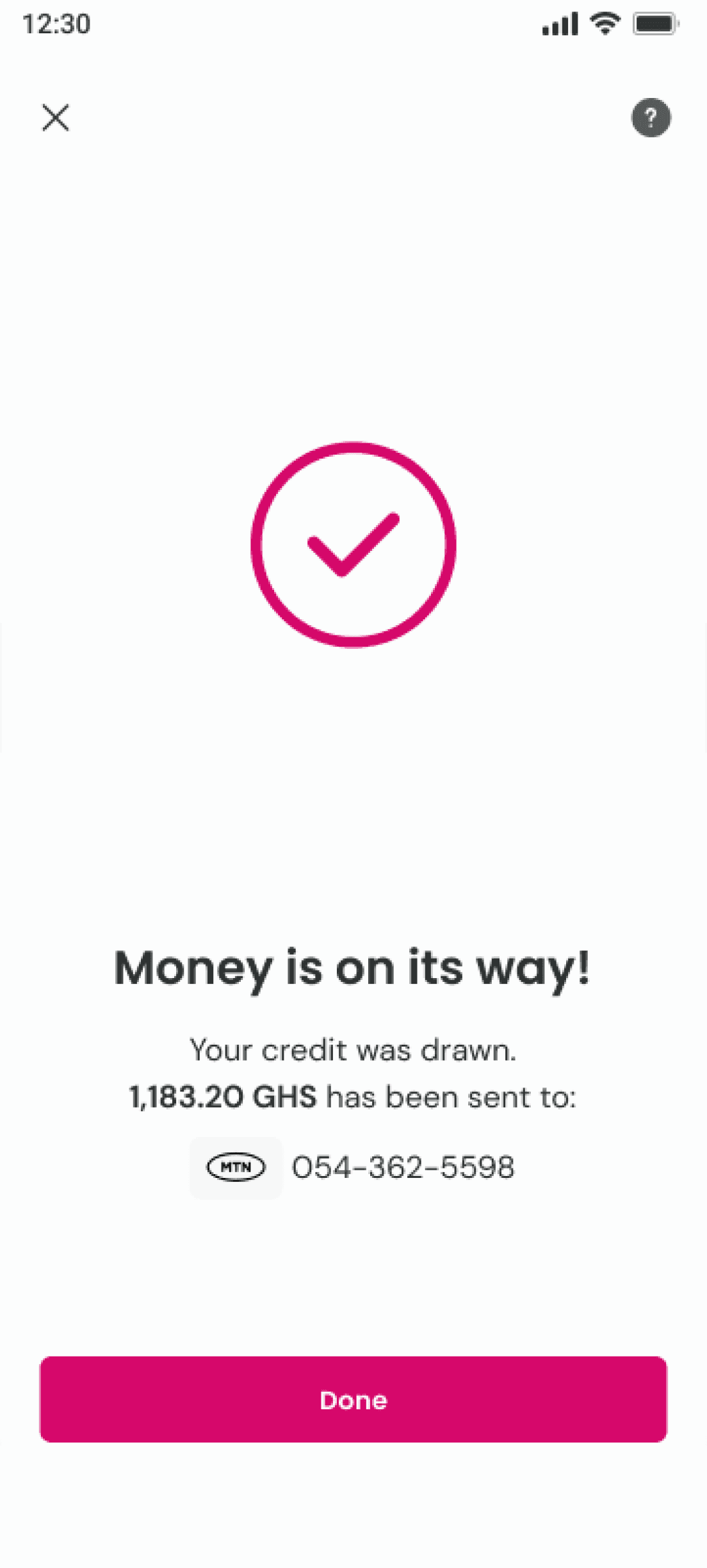

Effortless Credit Draw

Effortless Credit Draw

Effortless Credit Draw

Simplifying the process, we separated credit amount and repayment date screens presenting clear and bold details, reducing clicks and enhancing the user interface.

Simplifying the process, we separated credit amount and repayment date screens presenting clear and bold details, reducing clicks and enhancing the user interface.

Simplifying the process, we separated credit amount and repayment date screens presenting clear and bold details, reducing clicks and enhancing the user interface.

Swift Amount Selection

Swift Amount Selection

Swift Amount Selection

Offering popular amounts as quick-select chips, users can easily choose or manually input a custom amount.

Offering popular amounts as quick-select chips, users can easily choose or manually input a custom amount.

Offering popular amounts as quick-select chips, users can easily choose or manually input a custom amount.

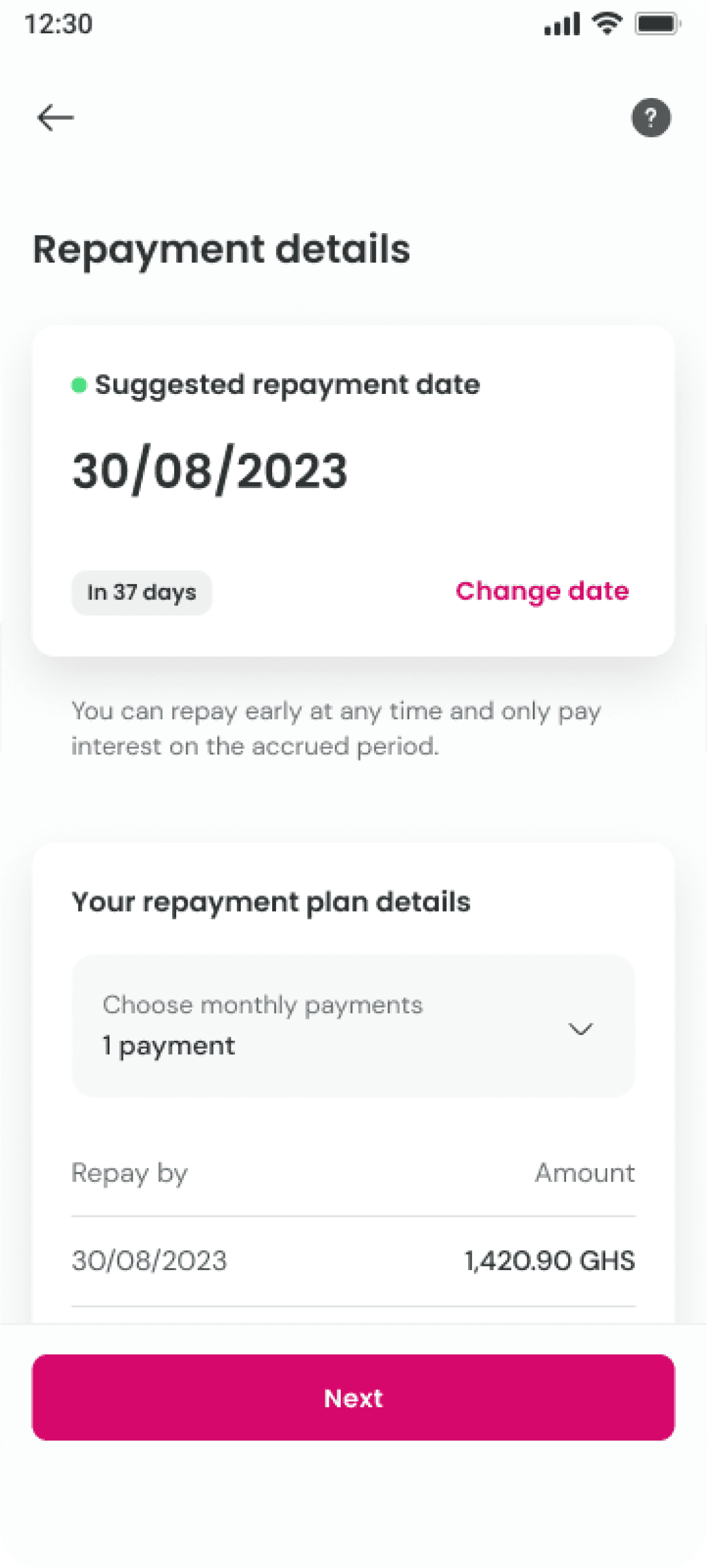

Optimal Repayment Dates

Optimal Repayment Dates

Optimal Repayment Dates

Providing recommended repayment dates aligned with users' paydays for convenient and timely repayment.

Providing recommended repayment dates aligned with users' paydays for convenient and timely repayment.

Providing recommended repayment dates aligned with users' paydays for convenient and timely repayment.

Transparent Transaction Details

Transparent Transaction Details

Transparent Transaction Details

Ensured clarity by transparently displaying all pertinent details, such as fees, charges, received amounts, and repayment figures.

Ensured clarity by transparently displaying all pertinent details, such as fees, charges, received amounts, and repayment figures.

Ensured clarity by transparently displaying all pertinent details, such as fees, charges, received amounts, and repayment figures.

Designs

Designs

Credit draw screens

Credit draw screens

Prototyping

Prototyping played a crucial role in our design process, facilitating comprehensive user testing to make our designs realistic. This ensures a smooth user experience, addressing and resolving any potential issues for a polished final product.

Prototyping

Prototyping played a crucial role in our design process, facilitating comprehensive user testing to make our designs realistic. This ensures a smooth user experience, addressing and resolving any potential issues for a polished final product.

Prototyping

Prototyping plays a crucial role in our design process, facilitating comprehensive user testing to make our designs realistic. This ensures a smooth user experience, addressing and resolving any potential issues for a polished final product.

Design system

I was responsible for developing and maintaining Fido's design system, ensuring a cohesive and user-friendly visual language throughout the app. This involved close collaboration with the development team to ensure alignment across all elements in the application of the design system.

Color palette

Primary

Hot pink 50

#FEE1EF

Hot pink 400

#D6086B

Hot pink 500

#D6086B

Neutral

White

#FFFFFF

Neutral 100

#F7F8F8

Neutral 300

#DFE2E2

Neutral 700

#6B7576

Neutral 800

#525A5B

Neutral 950

#2C3030

Complimentary

Aqua 25

#E5FDFF

Aqua 50

#D6FCFF

Aqua 100

#A3F8FF

Semantic

Warning/100

#FEF3C7

Warning/400

#FBBF24

Warning/600

#D97706

Negative/100

#FEE2E2

Negative/400

#F87171

Negative/600

#DC2626

Positive/100

#DCFCE7

Positive/400

#4ADE80

Positive/600

#16A34A

Label

Category

Completed

Typography

Aa

Poppins

Regular

Medium

SemiBold

Aa

DM Sans

Regular

Medium

Headline 1

Headline 2

Headline 3

Headline 4

Body L

Body L (Accented)

Body S

Body S (Accented)

Caption L

Caption S

Icons

Elevation

Corner radius

6px

8px

12px

16px

Input fields

Label

Label

Placeholder

Label

Placeholder

Popups

Popup Header

Display alerts, warnings, or confirmations, important information such as system status updates, notifications about new features, updates, or error messages.

Primary button

Minimal button

Navigation & Status

Badges

Label

Label

🚀

Label

Label

Label

🚀

Label

Label

Label

🚀

Label

Label

Label

🚀

Label

Selection

Label

☀️

Label

Label

Payment methods

054-362-5598

MTN Mobile Money

054-362-5598

MTN Mobile Money

Buttons

Button Large

Button Large

Button Large

Button Large

Button Small

Button Small

Button Small

Button Small

Radio

Label

Label

Tags

Label

Label

Label

Label

Label

Label

Label

✈️

Label

✈️

Label

✈️

Color palette

Primary

Hot pink 50

#FEE1EF

Hot pink 400

#D6086B

Hot pink 500

#D6086B

Neutral

White

#FFFFFF

Neutral 100

#F7F8F8

Neutral 300

#DFE2E2

Neutral 700

#6B7576

Neutral 800

#525A5B

Neutral 950

#2C3030

Complimentary

Aqua 25

#E5FDFF

Aqua 50

#D6FCFF

Aqua 100

#A3F8FF

Semantic

Warning/100

#FEF3C7

Warning/400

#FBBF24

Warning/600

#D97706

Negative/100

#FEE2E2

Negative/400

#F87171

Negative/600

#DC2626

Positive/100

#DCFCE7

Positive/400

#4ADE80

Positive/600

#16A34A

Label

Category

Completed

Typography

Aa

Poppins

Regular

Medium

SemiBold

Aa

DM Sans

Regular

Medium

Headline 1

Headline 2

Headline 3

Headline 4

Body L

Body L (Accented)

Body S

Body S (Accented)

Caption L

Caption S

Icons

Elevation

Corner radius

6px

8px

12px

16px

Input fields

Label

Label

Placeholder

Label

Placeholder

Popups

Popup Header

Display alerts, warnings, or confirmations, important information such as system status updates, notifications about new features, updates, or error messages.

Primary button

Minimal button

Navigation & Status

Badges

Label

Label

🚀

Label

Label

Label

🚀

Label

Label

Label

🚀

Label

Label

Label

🚀

Label

Selection

Label

☀️

Label

Label

Payment methods

054-362-5598

MTN Mobile Money

054-362-5598

MTN Mobile Money

Buttons

Button Large

Button Large

Button Large

Button Large

Button Small

Button Small

Button Small

Button Small

Radio

Label

Label

Tags

Label

Label

Label

Label

Label

Label

Label

✈️

Label

✈️

Label

✈️

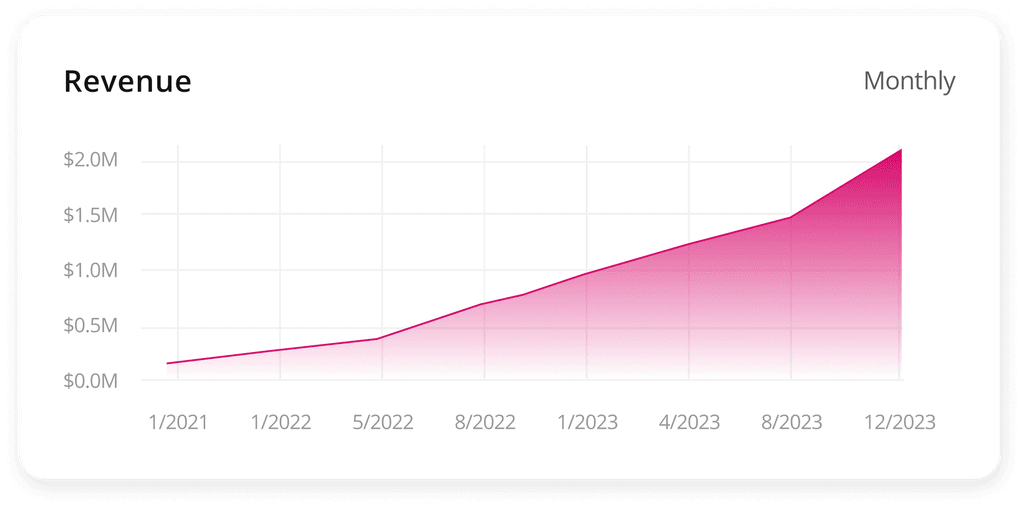

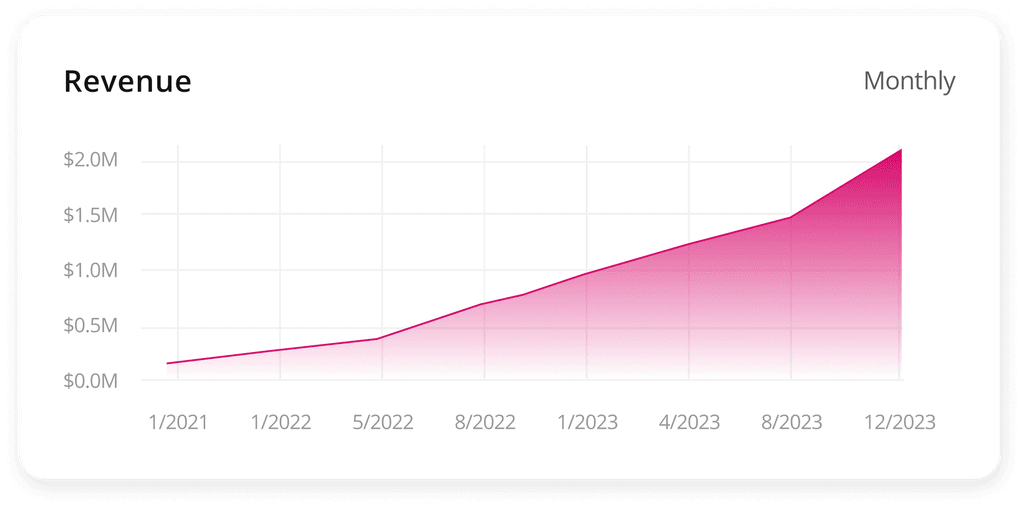

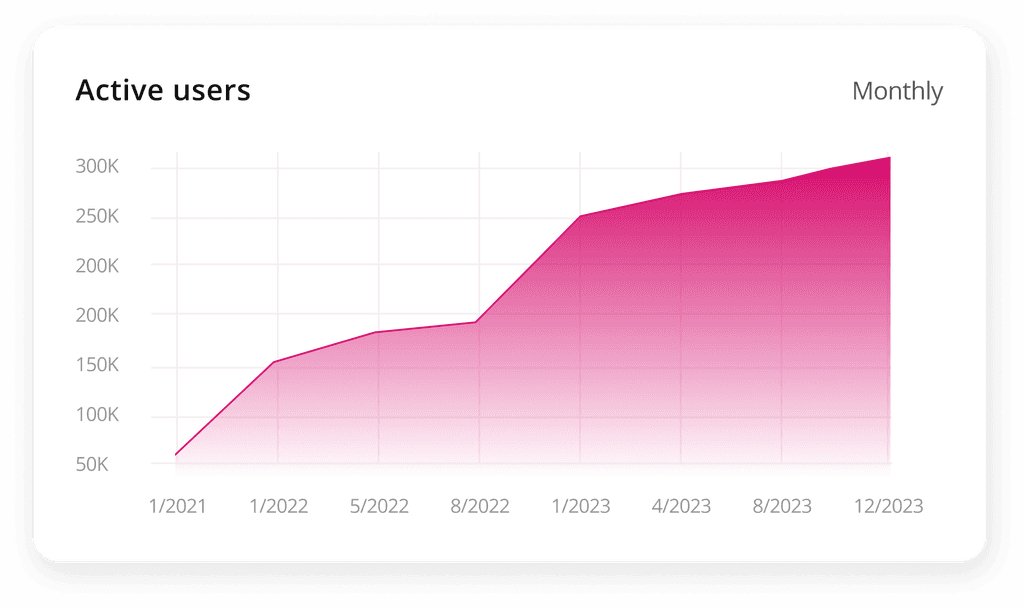

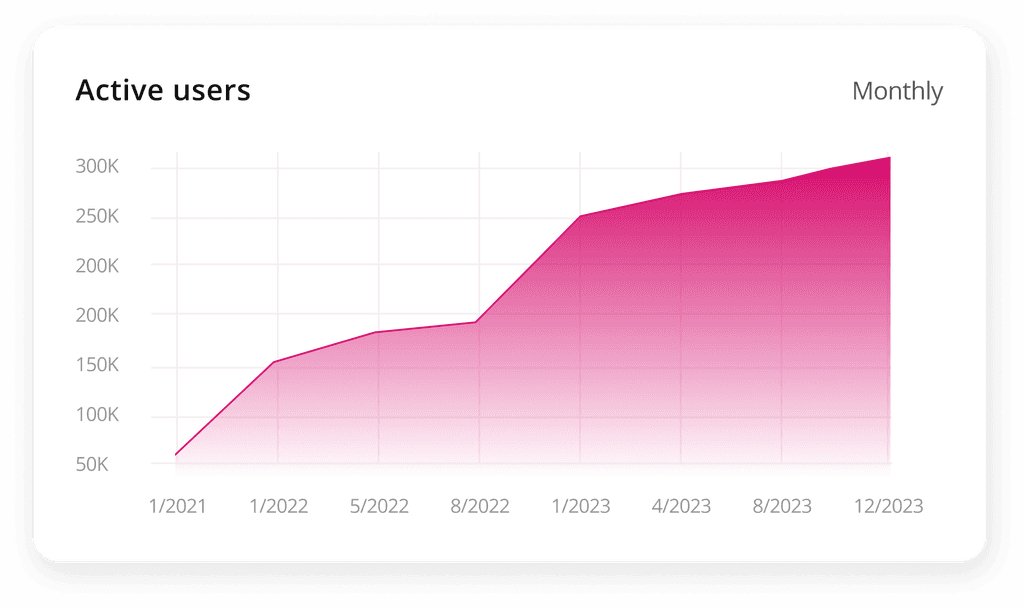

Product & business impact

Product & business impact

Since the launch of the new app, Fido has experienced remarkable success, witnessing a twofold increase in active monthly users and a fourfold surge in monthly revenues. This speaks to the substantial impact and positive reception of our enhanced product.

Since the launch of the new app, Fido has experienced remarkable success, witnessing a twofold increase in active monthly users and a fourfold surge in monthly revenues. This speaks to the substantial impact and positive reception of our enhanced product.

$2M monthly revenues

$2M monthly revenues

$2M monthly revenues

Climbing from $0.5 million to $2 million in monthly revenues.

Climbing from $0.5 million to $2 million in monthly revenues.

Climbing from $0.5 million to $2 million in monthly revenues.

300K Monthly active users

300K Monthly active users

300K Monthly active users

Monthly active users have doubled, starting from 150K and reaching 300K to date.

Monthly active users have doubled, starting from 150K and reaching 300K to date.

Monthly active users have doubled, starting from 150K and reaching 300K to date.

Conclusion

Conclusion

In our ongoing mission for financial inclusion, Fido has successfully served over 300,000 active users. Through thoughtful feature development, we've worked to make financial services more accessible across the African landscape.

In our ongoing mission for financial inclusion, Fido has successfully served over 300,000 active users. Through thoughtful feature development, we've worked to make financial services more accessible across the African landscape.

Key takeaways

Key takeaways

Deep User Understanding is Paramount

Deep User Understanding is Paramount

Understanding our users profoundly is not just a priority but a fundamental necessity. It shapes the success of our product and ensures its compatibility with the diverse needs of our users.

Understanding our users profoundly is not just a priority but a fundamental necessity. It shapes the success of our product and ensures its compatibility with the diverse needs of our users.

Never Cut Corners

Never Cut Corners

Even in seemingly trivial situations, cutting corners is not an option. Every user interaction contributes to the overall experience, making attention to detail crucial.

Even in seemingly trivial situations, cutting corners is not an option. Every user interaction contributes to the overall experience, making attention to detail crucial.

Never Assume Anything

Never Assume Anything

The principle of "never assume anything" guides us. It urges a thorough exploration of user needs, steering clear of assumptions that could impede our progress.

The principle of "never assume anything" guides us. It urges a thorough exploration of user needs, steering clear of assumptions that could impede our progress.

Looking forward

Looking forward

Fido is set to expand its innovative solutions to new countries, introduce impactful features for users' financial growth, and focus on tailored products to support businesses. Our mission remains constant: empowering lives through accessible and user-centric financial services.

Fido is set to expand its innovative solutions to new countries, introduce impactful features for users' financial growth, and focus on tailored products to support businesses. Our mission remains constant: empowering lives through accessible and user-centric financial services.

Want to hear more?

Want to hear more?

We were delighted to join Saar Gil on the Design Club podcast, where we delved into the crucial importance of meeting and understanding our users.

We were delighted to join Saar Gil on the Design Club podcast, where we delved into the crucial importance of meeting and understanding our users.

למה חשוב לפגוש את המשתמשים שלנו -

סער גיל מארח את נועה שטרן ואיתנה אפשטיין

למה חשוב לפגוש את המשתמשים שלנו - סער גיל מארח את נועה שטרן ואיתנה אפשטיין

האזינו לפרק

האזינו לפרק

Thank you for reading!

Take a look at more of my work

Design system

I was responsible for developing and maintaining Fido's design system, ensuring a cohesive and user-friendly visual language throughout the app. This involved close collaboration with the development team to ensure alignment across all elements in the application of the design system.

Typography

Aa

Poppins

Regular

Medium

SemiBold

Aa

DM Sans

Regular

Medium

Headline 1

Headline 2

Headline 3

Headline 4

Body L

Body L (Accented)

Body S

Body S (Accented)

Caption L

Caption S

Color palette

Primary

White

#FFFFFF

Hot pink 500

#D6086B

Neutral 950

#2C3030

Neutral

Neutral 100

#F7F8F8

Neutral 300

#DFE2E2

Neutral 800

#525A5B

Semantic

Warning/100

#FEF3C7

Warning/400

#FBBF24

Warning/600

#D97706

Negative/100

#FEE2E2

Negative/400

#F87171

Negative/600

#DC2626

Positive/100

#DCFCE7

Positive/400

#4ADE80

Positive/600

#16A34A

Icons

Navigation & Status

Buttons

Button Large

Button Large

Button Large

Button Large

Button Small

Button Small

Button Small

Button Small

Badges

Label

Label

🚀

Label

Radio

Label

Label

Thank you for reading!

Take a look at more of my work

Fido

Accessible & Inclusive financial opportunities in Africa

Fido

Accessible & Inclusive financial opportunities in Africa

Let’s Connect

Let’s Connect

Feel free to reach out for collaborations or just a friendly hello 😉

Feel free to reach out for collaborations or just a friendly hello 😉

epstein.etana@gmail.com